by Jossey PLLC | Jan 25, 2021 | SEC

Biden administration officials placed a plenary hold on all new regulations on the new president’s first day. The directive covers all rules not already effective even if published in the Federal Register. The SEC voted to harmonize and simply private capital rules (Final Rules) on November 2, 2020. The Federal Register published them on January 15, 2020. Now they must undergo further review and approval by the new agency head. If the Final Rules are delayed it could open a second comment period or the SEC chair could send them to OMB to kill them altogether.

Although the Final Rules are faulty in several respects including new Demo Day rules and crowdfunding special purpose vehicle rules, they vastly improve the status quo. Equity crowdfunding industry players lauded them especially increases in overall offer and induvial limits.

At the least, the Final Rules must now survive a 60-day hold. The agency head or designated person will review the rules for “questions of fact, law, and policy the rules may raise.” As the Final Rules completed a thorough 18-month process with robust public comment they are unlikely to face any ‘fact or law’ scrutiny. Policy, however, may be a different story. And it may depend on who does the review.

Biden Administration SEC pick or SEC Acting Chair will conduct review

President Biden has selected Gary Gensler to chair the SEC. His thoughts on the rules are at present unknown but Senators may hear them during the confirmation process. Mr. Gensler may not want to waste political capital on rules the Commission has already approved, undergone staff review, and are published in the Federal Register. This may be especially so with other Commission priorities like finally providing clear crypto guidance.

If for some reason the Senate holds up Mr. Gensler’s appointment, the task may fall to acting Chair Allison Herren Lee. Commissioner Herren Lee discussed the Final Rules in a public statement joining her ‘no’ vote. She stated her “concerns with the individual provisions of the final rule are numerous.” Her statement also made some questionable assumptions. For instance, “I question, for example, the wisdom of increasing capital raising limits in offerings such as Regulation A, Crowdfunding, and Rule 504 when investors have demonstrated no interest, and issuers no need, for such increases.” For support she cites, a comment letter stating only a fraction of Reg A+ and Reg CF offerings are hitting their maximum offering limits.

Delaying Final Rules will harm entrepreneurs, investors, and workers

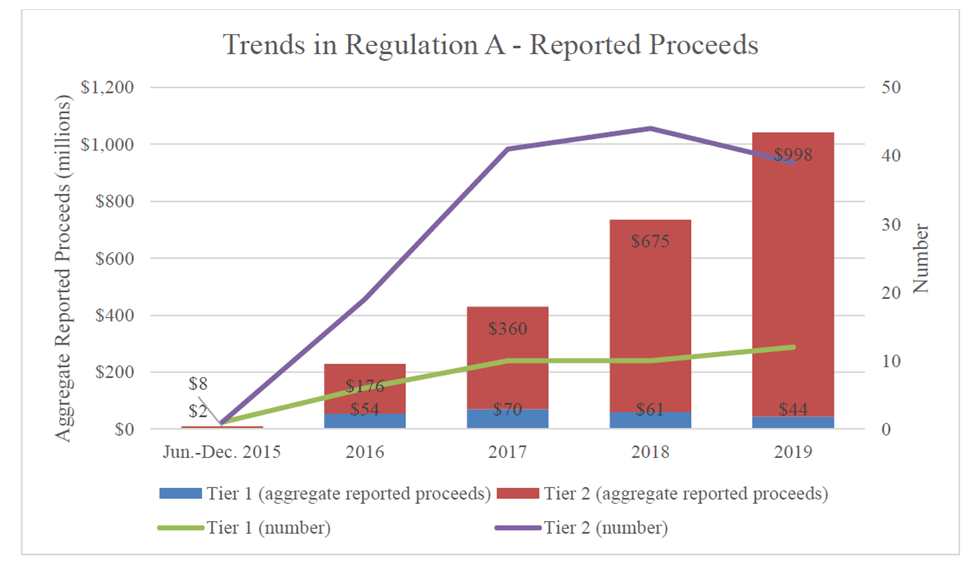

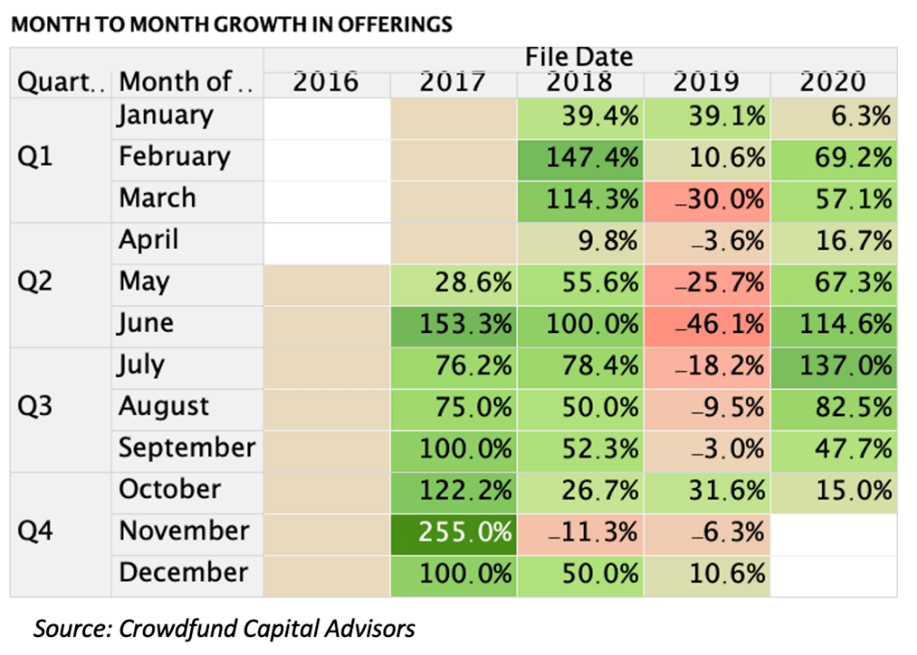

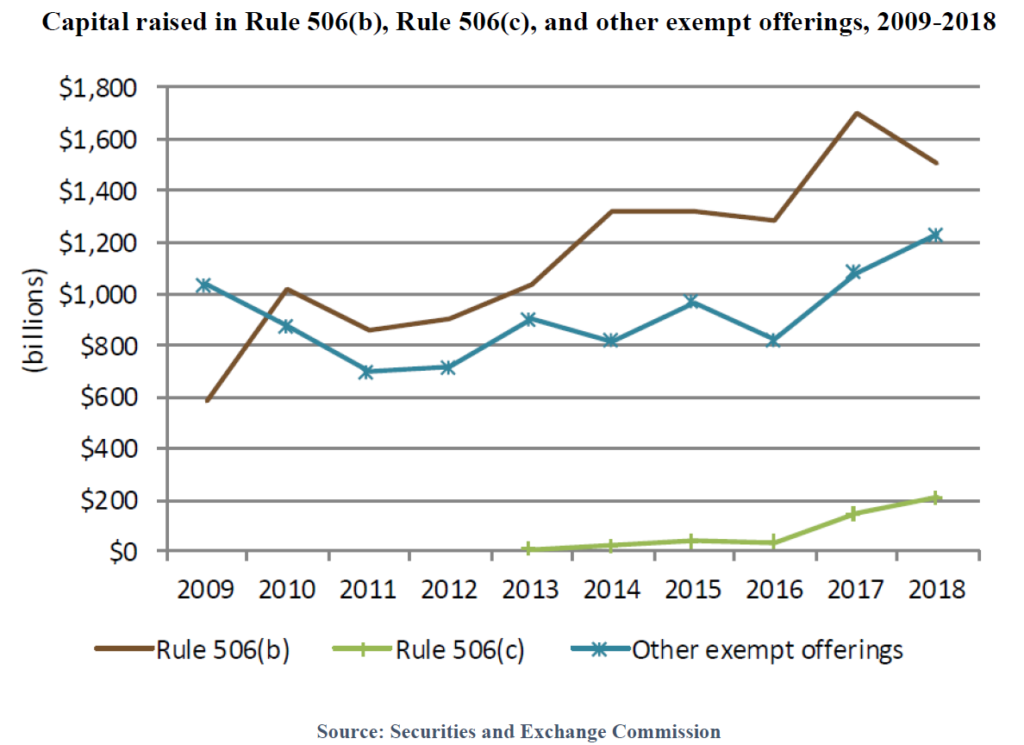

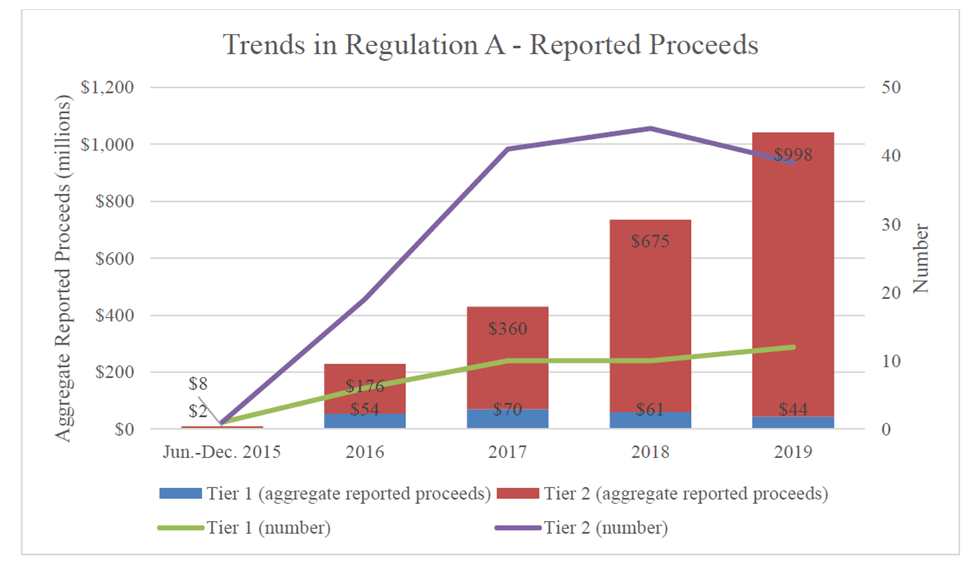

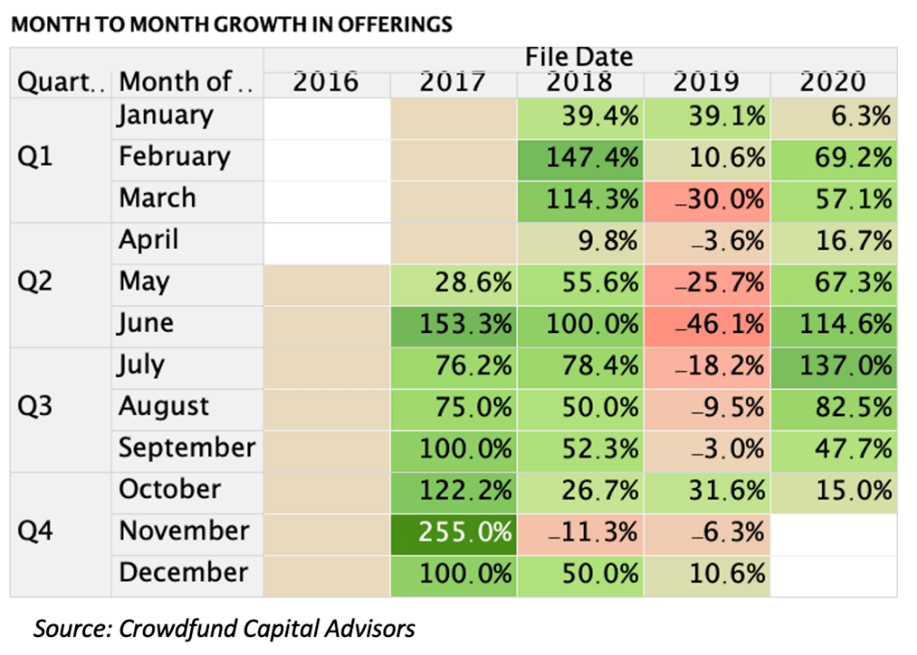

This is one way to look at it. Another is to observe the rapid growth in offerings as issuers, investors, and regulators adapt to the still-new exemptions. For instance, a 2020 SEC Reg A+ report shows steady use of the exemption and how it has particularly benefited certain industries including real estate and community banks.

Source: Securities and Exchange Commission

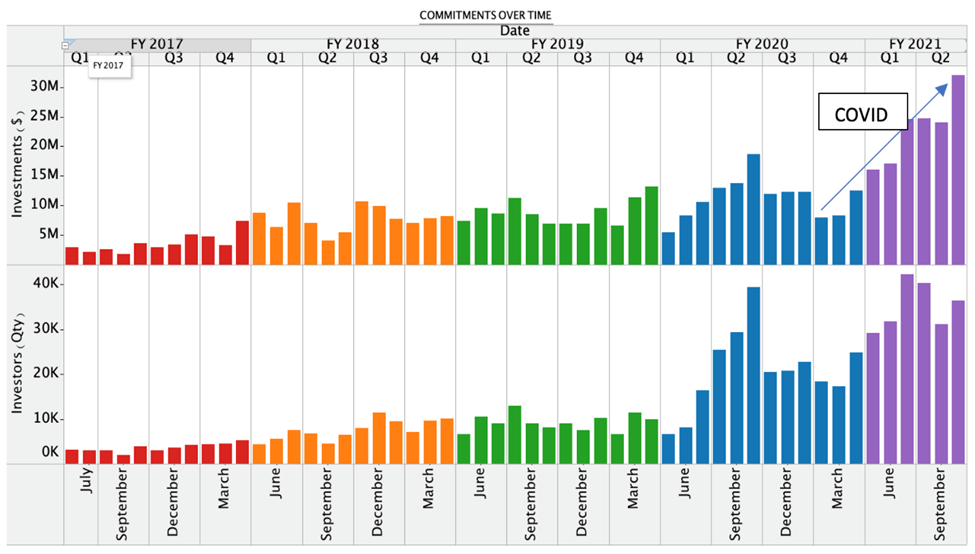

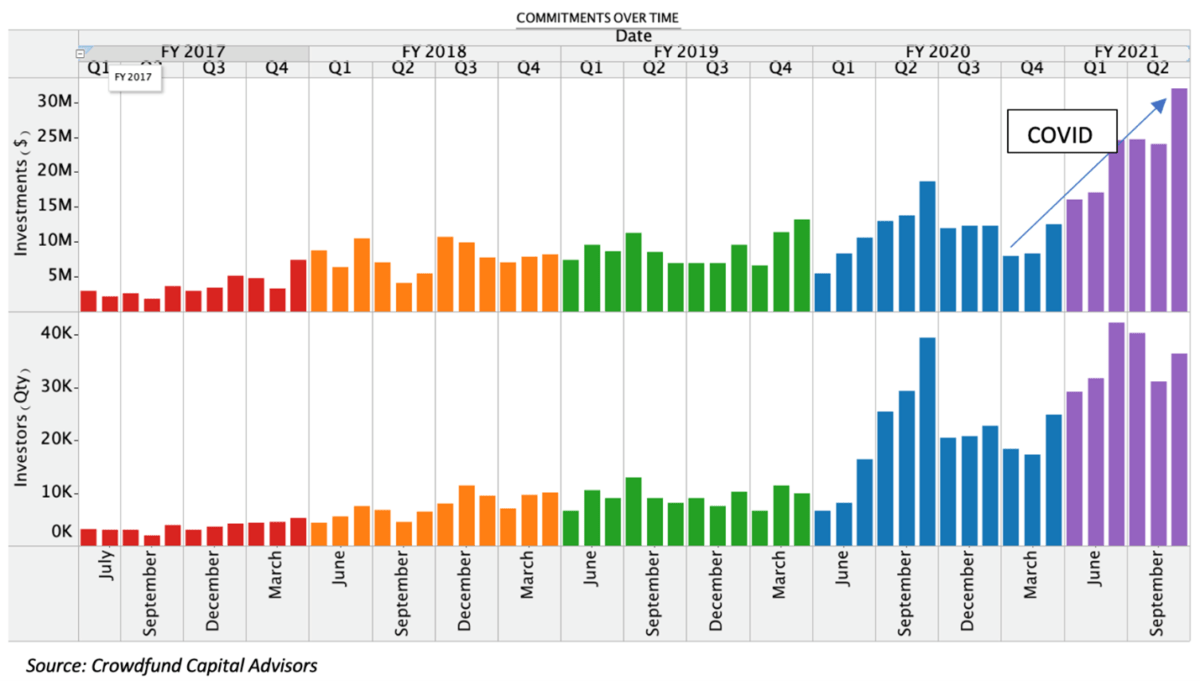

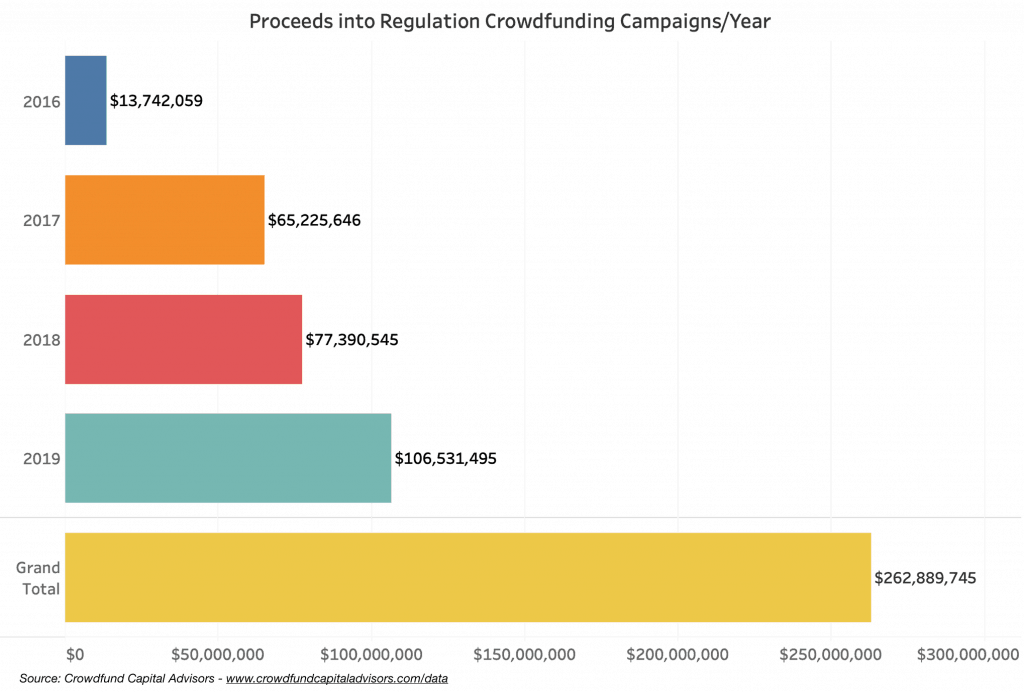

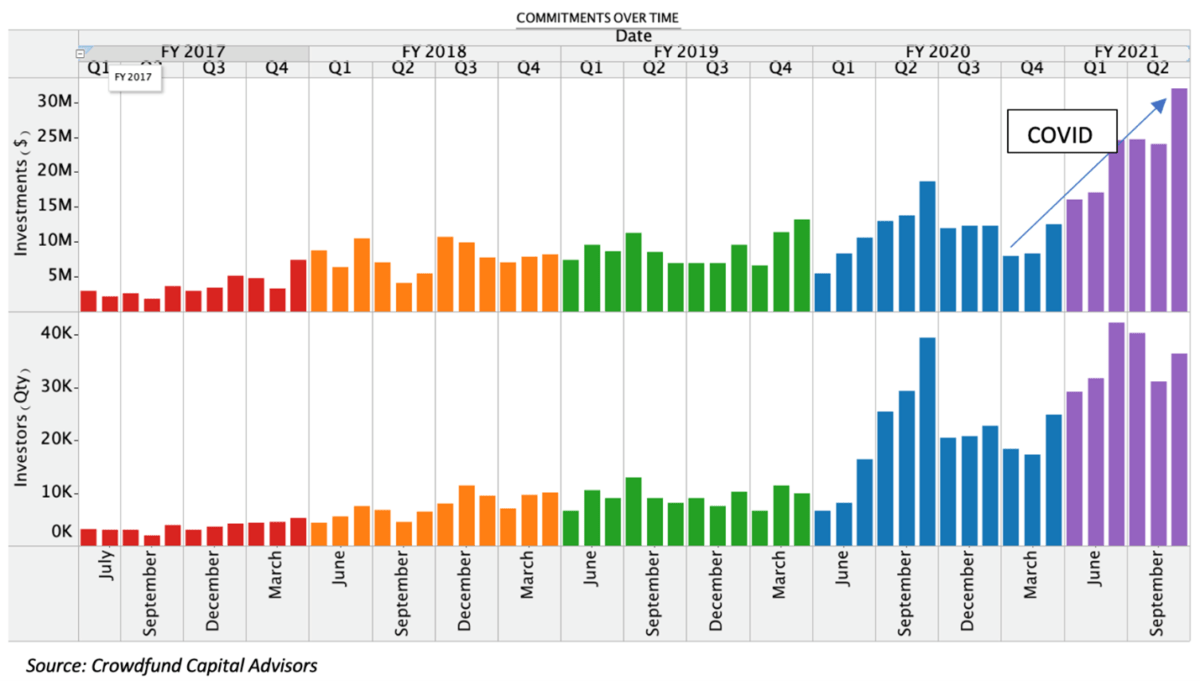

The Reg CF story is even more compelling. From 2018 to 2019 capital investment grew 37%. According to Crowdfund Capital Advisors, since the COVID pandemic Reg CF has exploded accounting for 300% growth from February to October 2020.

Source: Crowdfund Capital Advisors

Biden Administration taking cues from Congresswoman Maxine Waters

The Biden Administration’s moves appear to be the result of lobbying by Rep. Maxine Waters the Chairwoman of the House Committee on Financial Services. She sent two letters requesting the actions the Biden Administration eventually took, one on December 4, 2020 and a second on January 14, 2020.

Whilst everyone expects the typical gamesmanship of new administrations, Rep. Waters actions harm her constituents. Her district is 85% minority with 50% Hispanic and 20% Black. In her district, 37% of households earn less than $50,000 annually and 14.5% live under the poverty line.

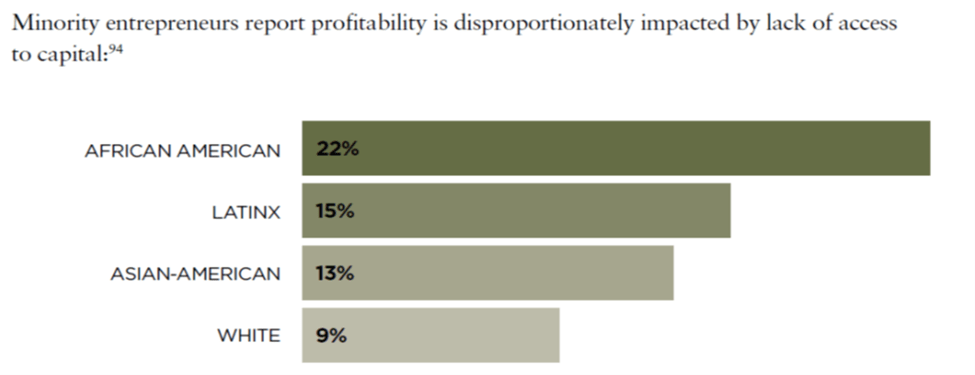

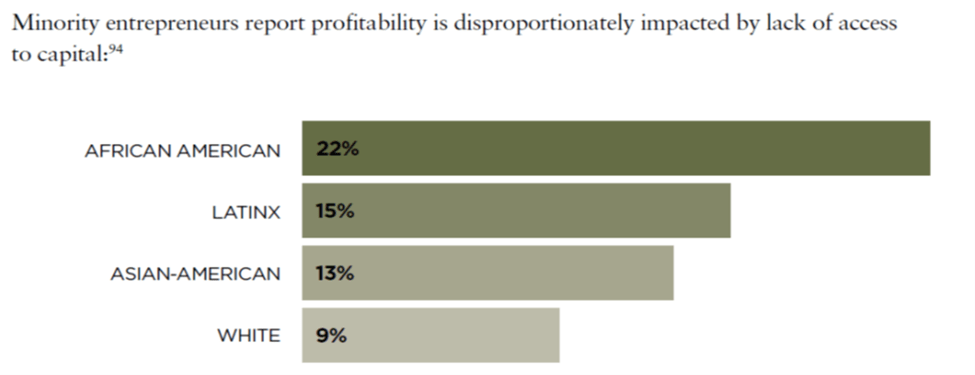

Congress designed the JOBS Act and especially Reg CF to help “outsider” entrepreneurs like many in Rep. Waters district. Startups in these areas need access to alternative capital as they are less likely to get conventional funding. According to the SEC Office of the Advocate for Small Business Capital Formation in its 2019 annual report, minority-owned businesses are three times more likely to be denied loans. Further new black-owned businesses start with almost three times less in terms of overall capital ($35,205) compared with new white-owned businesses ($106,720). Further minorities report this lack of capital access unduly harms business prospects.

Source: Securities and Exchange Commission

Rep. Waters could stop any delay to Final Rule implementation by letter to Mr. Gensler or Commissioner Herren Lee. She should. Too much is at stake for the future of alternative startup capital to play politics.

By Jossey PLLC via www.thecrowdfundinglawyers.com

by Jossey PLLC | Jan 2, 2021 | SEC

New Demo Day rules, part of the SEC’s new private-capital raising rules, polices speech and hurts entrepreneurs and investors. Demo Days are sponsored “pitch” events where founders present to potential investors.

Questions have long existed about whether these events trigger dreaded “general solicitation,” banned in Reg D 506(b). In theory, sponsors can avoid worry by inviting only accredited investors where a pre-existing substantive relationship exists. But this is impractical. And so, these events whilst valuable to speaker and audience come tethered with lawyer angst.

The SEC Final Rule (Rule 148) seeks to ease general solicitation concerns for Demo Day participants. But while marginally helpful, it misses the sponsor-founder-investor dynamic.

New Demo Day rules fail to reconcile the main point

At heart Demo Days are about speech. They entail all the awkwardness, adrenaline, excitement, and curiosity that surround high-stakes human interaction.

Part of the Commission’s goal in policing ‘general solicitation’ is to protect nonaccredited investors. It fears they may hear “broad offering related communications” for investments they can’t back. But at least one Commissioner doesn’t get it. As she often does, Commissioner Hester Peirce, staked a lonely position in her public statement after the Final Rules vote: “I would have favored loosening restrictions on the information permitted to be conveyed at these events and the individuals permitted to participate online, which frankly is the only way anyone is participating these days. How would attendees at these events be hurt by simply hearing details about an offering in which they cannot invest?”

Professor Usha Rodrigues reiterates this point. One the investor-protection focused Commission never seems to recognize. “Securities law . . . in theory, as in practice, marginalizes the average investor without acknowledging that it does so, let alone justifying it.”

New Demo Day rules disfavor tax-paying entities

To protect nonaccrediteds and ensure others don’t hear “too much,” Rule 148 mandates criteria that remove general solicitation worries. It limits who can sponsor Demo Days to a college, university, or other institution of higher education, State or local government or instrumentality thereof, nonprofit organization, or angel investor group, incubator, or accelerator. The Commission repeatedly states in policy for entities that lack profit motive.

But as Heritage Foundation David Burton Senior Fellow commented, official disfavor of profit is a government position lacking rationale:

The Commission should be reluctant to create artificial regulatory barriers to entrepreneurial capital formation unless there is a very sound policy reason to do so. It is also problematic to afford special advantages to governments or tax-exempt organizations. Paying taxes and running a business should not be disfavored. Thus, I would recommend allowing any business or organization to hold “demo days” unless the sponsor of the event is in a prohibited class (which in the proposed rule would include broker-dealers and investment advisers).

While also limiting sponsor and founder speech

Rule 148 restricts sponsor speech in numerous ways:. Adverts can’t mention specific offerings by the issuer; sponsors can’t make recommendations, engage in investment negotiations, or anything that may put them in broker-dealer land. Moreover, the Commission restricts sponsors’ and potential attendees’ freedom of association by limiting who can attend in person or virtually.

As important, Rule 148 caps founder speech to distinct bits of offer data: a notification that the issuer has an offer; the type and amount of securities being offered, the intended use of proceeds, and the unsubscribed amount.

Consumer lobbying groups and academics attack new Demo Day rules

Whilst some, like Commissioner Peirce may wonder what these speech and association controls accomplish, another group bitterly complained the new Demo Day rules portend a dark future for investors.

The Consumer Federation of America (CFA) leads the charge. This group which works closely with other union-backed and public-pension-funded groups including Healthy Markets, Better Markets, and the Council of Institutional Investors. These groups try to stifle founder speech and startup capital whilst trying to force companies into the public markets where they can be controlled.

CFA’s 58-page bromide attacks the Commission and Commissioners for failing to restrict companies’ and investors’ speech, freedom, and choices. This includes a rhetorical flourish where it accuses some Commissioners of abandoning the agency’s mission in the service of ideological-driven regulatory policy.

CFA’s Rule 148 attack typifies its view. It approvingly quotes a Mississippi law professor who accuses the Senate of engaging in “the de facto repeal of offering regulation” in an unpassed bill almost verbatim to Rule 148. The unpassed bill-turned-Rule 148 “purports to require that ‘no specific information regarding an offering of securities by the issuer [be] communicated or distributed by or on behalf of the issuer,’ and then creates an exception that covers all of the essential specific information that an issuer would want to communicate regarding its offering.”

Market Actors see things different

Sara Hanks disagrees. The CEO of Crowdcheck works with entrepreneurs. As someone who actually advises Demo Day presenters her view was practical. She accused Rule 148 of limiting issuers to “reading out tombstone adverts on a platform.” She then compared the speech-stifling approach to a Monty Python Cheese Shop sketch:

“So what traction do you have?” “Sorry, can’t answer that.”

“How is your solution better than your competitors?” “Sorry, can’t answer that.”

“What was your valuation on your Series B?” “Well actually . . . no, sorry, can’t answer that.”

The contrasting views expose the gulf between those that understand the grind of running a startup and raising capital and lobbying groups academics and that answer to the amorphous “public interest.”

Consumer groups want to curtail Demo Days

In fact, CFA frowns on pitch days in general, arguing they may favor some presenters over others. The Commission asserts loosening or at least clarifying these rules may help traditionally underfunded founders including women, but CFA disagrees.

It cites a female-led study that avers men are more likely to get Demo Day funding even when pitching the same company. CFA excludes the fact the study specifically states “good looking men” are most favored. So only a third of men may benefit if divided into three categories: unattractive, average, and good-looking. And instead of finding ways improve female founder pitching skills, which is essentially sales—a skill all founders must have. It instead attacks the Commission for sanctioning Demo Days at all.

New Virtual Demo Day rules arbitrarily exclude people

Rule 148’s virtual Demo Days restrictions also make no sense. Rule 148 caps virtual audiences so only select invitees can attend:

Individuals who are members of, or otherwise associated with the sponsor organization (for example, members of an angel investor group or students, faculty, or alumni of a college or university); (b) individuals that the sponsor reasonably believes are accredited investors; or (c) individuals who have been invited to the event by the sponsor based on industry or investment-related experience reasonably selected by the sponsor in good faith and disclosed in the public communications about the event.

The Commission considers this an investor protection:

The limitations we are adopting will help prevent broad offering communications over the internet to unlimited numbers of non-accredited investors by requiring the sponsor to limit participation to a population of potential investors related to the sponsor or about whose qualifications the sponsor has some knowledge, but at the same time will provide sponsors with ample flexibility to continue to conduct such events.

But how is preventing people from hearing truthful information via “broad offering communications” a worthy policy goal irrespective of statutory origins? As Commissioner Peirce might ask, what are the consequences? For instance, why does it benefit sponsor-university students to attend but not someone at a nearby junior college or the would-be entrepreneur saving to start a business. In fact, the prohibition functions like an arbitrary restriction on people’s First Amendment right to hear information.

The SEC should stop policing speech and focus on sales

Despite what consumer lobbying groups and academics might think, the SEC should stop regulating offers and exit the speech-policing business. No one is harmed just from hearing an offer. The rules reify concerns animating the original securities acts but untethered to the modern communications world.

The new Demo Day rules reflect a genuine Commission effort to improve and clarify rules. Unfortunately, it reinforces the reality that the Commission has anointed itself speech cops for so long it can’t grasp an alternative.

By Jossey PLLC via www.thecrowdfundinglawyers.com

by Jossey PLLC | Jan 1, 2021 | Crowdfunding, SEC

Reg CF SAFEs will stay. The SEC’s Final Rules reversed its proposal to remove Reg CF ‘nontraditional’ securities in its 18-month private-exemption review. Companies have used Simple Agreements for Future Equity (SAFEs), Simple Agreements for Future Tokens (SAFTs), and revenue shares in the Reg CF space, worrying the Commission about investor confusion. The surprise move came amidst uproar from market actors including portals that sell Reg CF securities.

Beyond investor confusion the Commission sought to algin Reg CF securities with Reg A+. Congress limited Reg A+ securities to: “equity securities, debt securities, and debt securities convertible or exchangeable to equity interests, including any guarantees of such securities.” But this wouldn’t have solved the Commission’s perceived problem since SAFE’s are “exchangeable to equity interests.” Thus, it went further and planned to explicitly ban SAFEs. Commentators balked, arguing SAFEs are just convertible notes with a zero percent interest rate. Removing the debt feature has many advantages, including eliminating tax-reporting headaches for what is usually minimal interest.

SAFE creator defends SAFEs

Carolynn Levy, the original SAFE creator at Y combinator submitted an SEC comment explaining SAFEs sought to “keep the convertibility feature of the [convertible] notes intact, but remove the debt features.” Others stated eliminating Reg CF SAFEs in name would mean issuers would still use them but call them ‘zero-interest convertible notes.’ Thus, eliminating Reg CF SAFEs would not kill the concept but would only add extra paperwork and compliance hours for the same thing.

SAFEs also have other advantages. As Sara Hanks, CEO of Crowdcheck stated in her SEC Comment, “One of the primary drivers of the use of SAFEs is to delay substantive analysis of the valuation of the issuer when that issuer is still in its developmental stages.” Startups are notoriously hard to value, many will fail, many won’t scale, making early valuations mostly useless. As Reg CF caters to early-stage companies, priced rounds make little sense.

SAFEs convert to equity upon a set of defined triggers. Most often that trigger is a future financing round. As the Wefunder SEC comment stated, SAFE holders are betting the company will attract later funding. If it does the SAFE converts, if it doesn’t needless lawyer billables aren’t wasted. In Silicon Valley equity raises don’t usually begin until the $2 million mark, when VCs negotiate Series A. But companies eschewing VC money can trigger SAFE conversion with a merger, public offering, or later Reg A+ financing.

Reg CF SAFE complaints focus on generally accepted practices

Reg CF SAFE complaints focus on issues common in the Reg CF area. First is lack of Reg CF SAFE voting rights. But any kind of security can prohibit voting, including common stock. In fact, Reg CF securities typically avoid voting rights. It would make no sense for investors with commitments as little $100 and companies with management structures often in flux. Thus, Mississippi law professor Mercer Bullard complaint quoted by the Consumer Federation of America in its SEC comment makes no sense.

And it is typical of academic hostility to innovation and capitalism. Bullard states, “These three types of securities [SAFEs, crowd notes, and revenue shares] share the disadvantages that they are nonvoting and lack the information rights that are typical for common shareholders.” Mandating voting rights or limiting security structures will only force companies to forgo crowdfunding and harm choices for retail investors. Ironically these are the cohorts consumer groups and academics claim to defend.

A second Reg CF SAFE complaint is the typically included repurchase provisions. This allows issuers to buyout SAFE holders after later financing. But again, buyback provisions exist with any security type including common stock. One reason buyback provisions are necessary is the 12(g) rule. This rule forces young companies with “too many” investors to worry about being forced into the public markets. The SEC conditionally exempts Reg CF investors from this count. But it could have exempted them unconditionally. Not doing so necessitated buy-back provisions in Reg CF securities.

Nontraditional Reg CF instruments will lead to industry disruption

Other ‘nontraditional’ securities popular in Reg CF are SAFTs and revenue shares. The Commission’s struggle with token sales is well known and unresolved. It’s attempt to clarify its position in 2019 guidance was a legendary fail. Its appointment of a “Crypto Czar” Valerie Sczcepanik solved nothing. And banning Reg CF SAFTs change little.

Last is revenue shares. In contrast to most securities, revenue shares are easy to understand. Investors get a prorated share of company revenue. Reg CF Rev-Share-holders are not equity holders who may have to wait years for a return. ‘Businesses’ based on single project like a movie, literary work, or music album can thrive with this model. It aligns the project’s backers with the creators for marketing and signal boosting. One VC fund involved with video games and virtual reality already employs this model. More will follow as the entertainment evolves to include fans as stakeholders.

The SEC’s reversal on Reg CF SAFEs, SAFTs, and revenue shares was welcome and wise. It aligned with the overall move to allow companies and retail investors more freedom and choices. Whilst unpopular with anti-innovation academics and the consumer lobbyists, it will ultimately benefit everyone as new and profitable capital-raising models emerge.

By Jossey PLLC via www.thecrowdfundinglawyers.com

by Jossey PLLC | Nov 6, 2020 | SEC

Crowdfunded startups received a major boost when the Securities and Exchange Commission (SEC) voted on proposals earlier this week to tweak Regulation Crowdfunding (Reg CF or equity crowdfunding). Reg CF allows entrepreneurs and small businesses to seek investment from the ‘crowd,’ greatly expanding their potential-investor pool.

The changes join a larger Commission effort to simplify the private-exemption rules and expand capital access for growing ventures. As SEC Chair Jay Clayton stated, “For many small and medium-sized business, our exempt offering framework is the only viable channel for raising capital. . . . The staff has identified various costly and unnecessary frictions and uncertainties and crafted amendments that address . . . inefficiencies in the context of a more rational framework that will facilitate capital formation for small and medium-sized businesses and benefit investors for years to come.”

The Commission was particularly attentive to impediments crowdfunded startups faced. Through Commission-requested comments, industry participants detailed myriad regulatory hurdles startups and small businesses face when using this exemption. These included low aggregate offering limits, discordant and confusing individual investor limits, restrictive solicitation rules, and capitalization table issues.

SEC modifies rules to help crowdfunded startups

The SEC listened and changed rules that were impeding Reg CF growth. Among the beneficial changes:

- Raising the aggregate offer limit from $1.07M to $5M.

- As Crowdfund Capital Advisors, which curates equity crowdfunding data stated about this change: “At $5 million, a tech startup can raise a seed round or a traditional small or mid-sized company can raise expansion capital. This will open significant new opportunities for businesses to use this capital to recover from the current economic crisis or launch innovative new products and services.”

- Removing individual investor limits for accredited investors.

- This rule had perplexed many industry participants. Its removal now aligns Reg CF with the more established Reg D and Reg A+ exemptions, where accredited investors faced no such limits.

- Allowing potential issuers to gauge interest in a raise (“test the water”) before filing.

- This change is especially helpful for less experienced entrepreneurs unaccustomed to securities law’s confusing array of rules on what they can say and when (and the policy reasons behind them).

- Allowing Special Purpose Vehicles (SPVs) to cabin all Reg CF investors into one legal “bucket.”

- The call for SPVs has been perhaps the most persistent complaint from industry participants about Reg CF. Although questions remain about how this rule will function in practice, ideally it will solve the “messy cap table” issue frowned on by later investors.

- Extend relief from financial-statement requirements for issuers seeking under $250k.

- Although separate from the Commission’s summer 2019 initiative, the commissioners voted to extend for 18 months a temporary exemption from Reg CF’s financial statement-review requirements for issuers offering less than $250k in securities.

In surprise move, SEC allows crowdfunded startups to keep using SAFEs

A final surprising and welcome development is the Commission voted not to restrict security type as it had proposed. The Commission had previously expressed concern about certain financial instruments such as Simple Agreements for Future Equity (SAFE). Also scheduled for elimination were other nontraditional but helpful instruments like revenue shares and token-based structures. The Commission deserves credit for resisting its regulatory urge. These innovative structures that lacked any evidence investors were unhappy or confused by them.

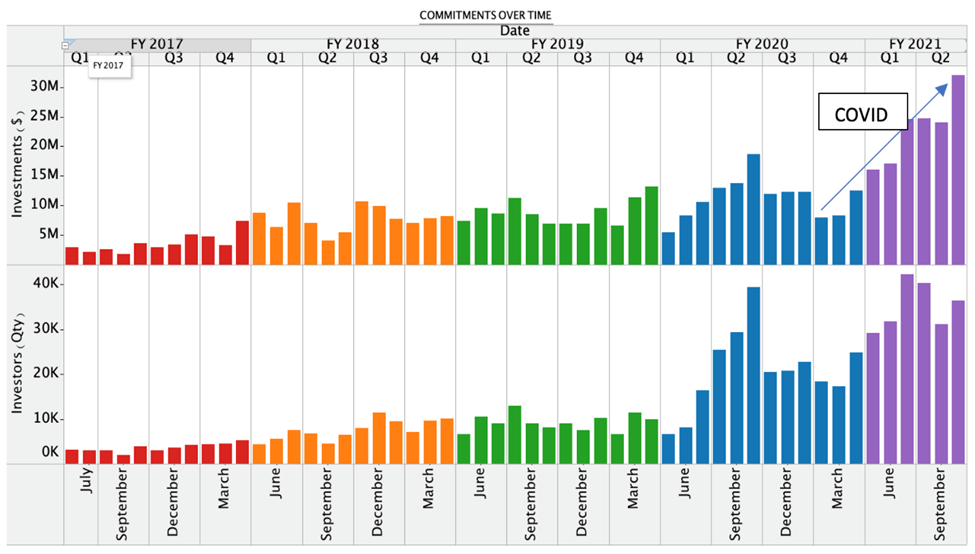

Reg CF was already growing, new rules could see explosive growth

Despite the now-cured impediments and after a slow start, Reg CF had already found its footing. Aided in part by the ease of investing online during the pandemic, Reg CF has set multiple records this year. This includes its best month ever in October ($32 million committed investments). According to Crowdfund Capital Advisors, the past six months have seen a 300% increase in investor commitments.

Moreover, the number of offerings year-to-year has continued growing as more businesses incorporate equity crowdfunding into their capital-raising plans.

Crowdfunded startups could soon become the norm

Equity crowdfunding is set for explosive growth in the years ahead. The new rules will boost Reg CF’s already impressive momentum as more businesses and investors learn about and use this innovative tool.

The new rules will be effective 60 days after publication in the Federal Register. This doesn’t include the extension of the temporary Regulation Crowdfunding provisions. These will be effective upon publication in the Federal Register.

By Jossey PLLC via www.thecrowdfundinglawyers.com

by Jossey PLLC | Sep 28, 2020 | Crypto, SEC

By greenlighting a banking rule, the feds again inched toward accepting the crypto revolution. The Office of the Comptroller of the Currency (OCC) declared big banks may hold stablecoin reserves for clients in hosted wallets. The statement follows this summer’s OCC proffer big banks could custody crypto. Always ahead of the curve, the most recent statement okayed a years-long practice but limited it unnecessary ways.

Stablecoins are tied to a fiat currency, or some other “stable” reserve like commodities or other cryptocurrencies. The tether can be a direct 1:1 peg or algorithm managed. Entrepreneurs created stablecoins to smooth crypto volatility.

Without government permission, the stablecoin market had swiftly grown. Coindesk reports from September 2019 to September 2020 the market jumped from $5 billion to $19 billion—much of it already backed by large financial institutions. But OCC unnecessarily limited stablecoin acceptance to 1:1-backed stablecoins and those in “hosted wallets,” presumably excluding business and individual wallets. This is bound to confuse and catalyze the need for further government clarification.

The SEC, always around, never there

And then there is the always-lurking Securities and Exchange Commission. The SEC is the exemplar of foot-dragging slow-reacting bureaucratic power. Anyone familiar with Commission documents could have written its statement beforehand plus or minus a few words. It states the OCC interpretation is limited, any securities analysis will be based on “facts and circumstances,” the aspiring stablecoin creator should visit, and “if appropriate” the Commission may issue a No Action Letter.

Perhaps no federal agency has ever used a phrase more than the SEC does “fact and circumstances.” What this phrase means is it will not provide clear public guidance on the fear that someone will subvert it and Commission would get blamed. It puts the burden on entrepreneurs to dance the SEC tune beforehand or risk a years-long investigation.

The Commission couches this invitation in nondescript language. “The Staff stands ready to engage with market participants to assist them and to consider providing, if appropriate, a “no-action” position regarding whether activities with respect to a specific digital asset may invoke the application of the federal securities laws.”

The Commission greenlights stablecoin disclaimers

But anyone who has talked with said Staff knows this isn’t quite true. Engagement is a regulatory two-step. You can talk to them, but don’t expect answers. They disclaim responsibility for their words. Here is last week’s example:

This statement represents Staff views and is not a rule, regulation, or statement of the Commission. The SEC has neither approved nor disapproved its content. SEC Staff statements, like all SEC Staff guidance, have no legal force or effect: they do not alter or amend applicable law, and they create no new or additional obligations for any person.

Got that? Come talk to us but don’t take our words seriously. The only surefire way to avoid a “facts and circumstances” probe is a No Action Letter. But that could take months, even years, and has limited precedential value.

NPC Valerie, SEC stablecoin czar

In the crypto world, the SEC’s top talker is NPC Valerie—a career bureaucrat. Before the virus NPC Valerie traveled the country attending conferences and grinding ad nauseum the Commission’s “facts and circumstances” and “Howey” tread. Here is her answer on whether algorithmic stablecoins constitute securities: “You might be getting into the land of security.” What does that mean? Nobody knows. It depends of course on the “facts and circumstances.”

The Commission kicker was a citation to the infamous April 2019 “guidance.” Insiders and media mocked the document as a confusing morass of nothingness. It stands thus far as NPC Valerie’s most comprehensive work product. (She didn’t sign it of course, why take responsibility for such a mess?) At the time Coindesk’s lead story was titled ‘SEC’s Crypto Token Framework Falls Short of Clear and Actionable Guidance.’ The Harvard Law Review called it “an inadequate substitute for clear legislation and judicial rulings.”

Crypto Mom breaks the mold

And Hester Peirce, aka Crypto Mom, at times the Commission’s lone voice of reason didn’t hold back:

While Howey has four factors to consider, the framework lists 38 separate considerations, many of which include several sub-points. A seasoned securities lawyer might be able to infer which of these considerations will likely be controlling. And might therefore be able to provide the appropriate weight to each. Whether the framework gives anything new to the seasoned securities lawyer used to operating in the facts and circumstances world of Howey is an open question. I worry that non-lawyers and lawyers not steeped in securities law and its attendant lore will not know what to make of the guidance.

Pages worth of factors, many of which seemingly apply to all decentralized networks, might contribute to the feeling that navigating the securities laws in this area is perilous business. Rather than sorting through the factors or hiring an expensive lawyer to do so, a wary company may reasonably decide to forgo certain opportunities or to pursue them in a more crypto-friendly jurisdiction overseas.

Commissioner Hester Peirce, AKA Crypto Mom

It is a testament to the Commission’s failed leadership that it still cites guidance people both inside and outside government have branded useless.

The feds have once again inched toward opening our decentralized, privatized future through stablecoin acceptance. They could help even more by providing clear rules and getting out of the way.

By Jossey PLLC via www.thecrowdfundinglawyers.com

by Jossey PLLC | Sep 6, 2020 | Crowdfunding, SEC

To much fanfare, the Securities and Exchange Commission (SEC) recently expanded the Accredited Investor (AI) definition. Individuals can now qualify as AIs via sophistication criteria and not just hard monetary limits. This change will increase the AI pool for startups and small businesses seeking investment. But it mainly affects Reg D offerings—by far the largest private exemption—which offers a binary: AIs can invest, non-AIs can’t.

Reg D’s dominance of the private markets is clear. In 2019 Reg D 506(b) issuers raised almost $1.5 billion. It dwarfs other exemptions like Reg A+, Reg CF, and Reg D 506(c) (similar to Reg D 506(b) except it allows general solicitation).

But how the new definition affects equity crowdfunding (Reg CF) is more complex. The short answer for now, is, it doesn’t. Because Reg CF already allows anyone to invest, more AIs are irrelevant. But it could matter soon, if the Commissioners approve the March 2020 proposals from last year’s Concept Release. For now, however, the hash Congress and the SEC made of Reg CF’s individual investor limits prevents the AI expansion from having impact.

Congress’s Reg CF individual investor limit exemplified bad drafting.

As enacted in Title III of the JOBS Act, Reg CF individual investor limits reads:

[T]he aggregate amount sold to any investor by an issuer, including any amount sold in reliance on the exemption provided under this paragraph during the 12- month period preceding the date of such transaction, does not exceed— ‘‘(i) the greater of $2,000 or 5 percent of the annual income or net worth of such investor, as applicable, if either the annual income or the net worth of the investor is less than $100,000; and ‘‘(ii) 10 percent of the annual income or net worth of such investor, as applicable, not to exceed a maximum aggregate amount sold of $100,000, if either the annual income or net worth of the investor is equal to or more than $100,000

Like most statutes this passage shows how lawmakers should not write laws. Congress could have defined a hard limit adjusted for inflation for non-AIs and no limit for AIs. Instead, Congress divided the Reg CF limit into four categories: (i) 5% of annual income; (ii) 5% of net worth; (iii) 10% of annual income; and (iv) 10% of net worth. Then it added a floor, $2,000 and a ceiling, $100,000.

It gets “better.” Congress failed to specify when each limit applies. Part one states, “if either annual income or net worth is less than $100,000 and part two states “if either the annual income or net worth . . . is equal to or more than $100,000.” So which is it? If someone’s income was $150,000 and net worth was zero, he would qualify for both brackets. And once in the bracket which limit applies, annual income or net worth? In the previous example if placed in the 5% bracket the limit would either be $2000 or $7,500.

The SEC interpreted Congressional ambiguity in the worst possible way

Congress tasked the SEC with writing the Reg CF rules and cleaning up its textual mess. In its typically chary way, the SEC chose the worst possible interpretation. First it declared investors must meet the $100,000 threshold for both income and net worth for the 10% bracket. Second it chose the lesser of income or net worth once placed in either bracket. Thus, is the previous example the rules limited the $150,000 salaried person with no net worth to $2,000.

The Commission originally proposed the greater of standard but changed course because of the supposed greater equity crowdfunding risks:

We recognize that this change from the proposed rules could place constraints on capital formation. Nevertheless, we believe that the investment limits in the final rules appropriately take into consideration the need to give issuers access to capital while minimizing an investor’s exposure to risk in a crowdfunding transaction.

Importantly, the Commission also declined to exempt AIs from the formula. This distinguished Reg CF from Reg D and Reg A+ where accredited investors face no caps.

Equity crowdfunding continues to flourish despite bad drafting and regulatory hurdles

Despite government obstacles equity crowdfunding continues to grow. In arguing against expanding the AI definition a group of state attorneys general cited Reg CF underuse as evidence for restricting AIs.

[T]he equity crowdfunding market . . . has largely been underwhelming expectations despite significant deregulation to allow individual investors all along the financial spectrum to participate. Instead of a booming marketplace, equity crowdfunding has remained a niche market with fundraising falling well below the statutory caps and issuer-generated maximum targets for their offerings.

The AGs don’t mention the Commission-led barriers placed in Reg CF’s path, including confusing investment limits. Nonetheless after a slow start Reg CF has gained substantial ground in the past two years. According to Crowdfund Capital Advisors Reg CF investment jumped 37% between 2018 and 2019.

Equity Crowdfunding portals are having a record year

Further massive Reg CF portals SeedInvest and Wefunder have reported their best months ever in 2020. And despite endless handwringing from regulators, academics, and nonprofits, Reg CF has not experienced predicted fraud and high-risk speculative investments. The Commission admits as much in its 2019 review of the exemption’s performance:

During the considered period, there were few instances of legal proceedings (involving FINRA or the Commission) referencing Regulation Crowdfunding, so we cannot infer a systematic relation between any particular characteristics of the offerings and the incidence of such legal actions. In particular, a search of publicly available information in the Commission’s litigation releases has not identified civil complaints or administrative proceedings filed against Regulation Crowdfunding issuers or intermediaries. We have, however, identified four actions initiated by FINRA against a funding portal member that involved alleged violations of Regulation Crowdfunding or FINRA rules.

The Proposed Rules along with the expanded AI definition will improve equity crowdfunding

Equity crowdfunding seems poised to become a “booming marketplace” with the expanse of time and more favorable rules. Four years after a decidedly jaundiced Commission wrote Reg CF’s rules it has finally proposed improvements. One proposal seeks to correct its individual investment-limit mistakes. First it has proposed switching to the originally proposed “greater of” standard. Also, it has finally proposed lifting the caps for AIs. Assuming the Commission adopts the proposals as is, more equity crowdfunding investors will be free to invest without limits. This will further enhance Reg CF’s attractiveness to issuers and investors alike inching it toward the “booming marketplace” of state AG dreams.

By Jossey PLLC via www.thecrowdfundinglawyers.com