To much fanfare, the Securities and Exchange Commission (SEC) recently expanded the Accredited Investor (AI) definition. Individuals can now qualify as AIs via sophistication criteria and not just hard monetary limits. This change will increase the AI pool for startups and small businesses seeking investment. But it mainly affects Reg D offerings—by far the largest private exemption—which offers a binary: AIs can invest, non-AIs can’t.

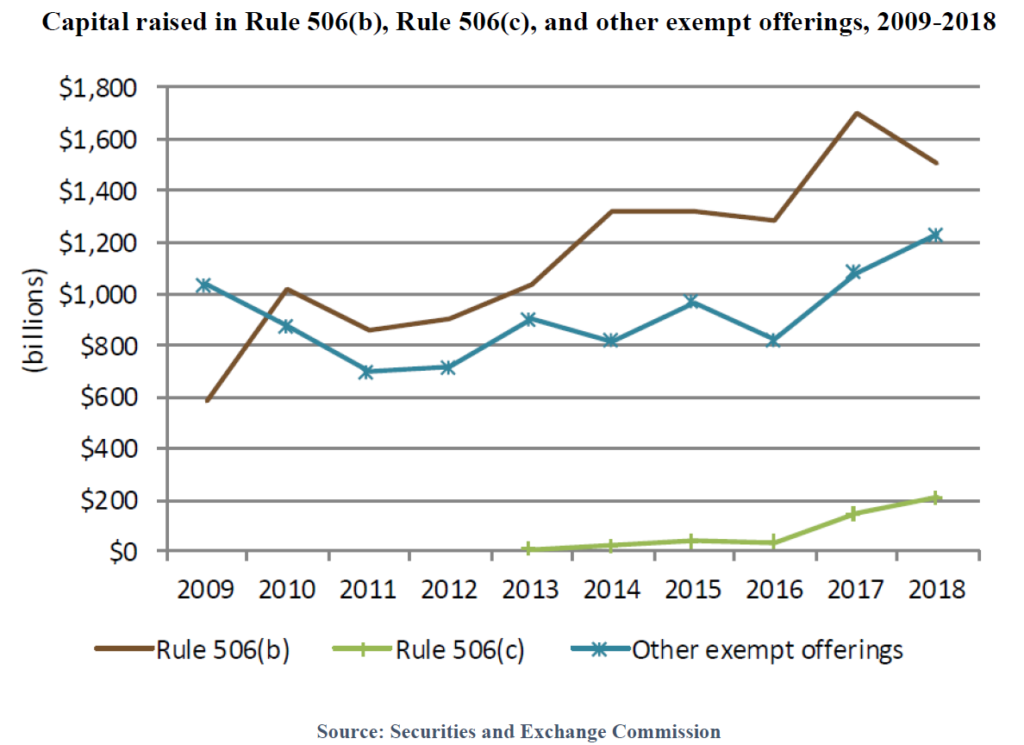

Reg D’s dominance of the private markets is clear. In 2019 Reg D 506(b) issuers raised almost $1.5 billion. It dwarfs other exemptions like Reg A+, Reg CF, and Reg D 506(c) (similar to Reg D 506(b) except it allows general solicitation).

But how the new definition affects equity crowdfunding (Reg CF) is more complex. The short answer for now, is, it doesn’t. Because Reg CF already allows anyone to invest, more AIs are irrelevant. But it could matter soon, if the Commissioners approve the March 2020 proposals from last year’s Concept Release. For now, however, the hash Congress and the SEC made of Reg CF’s individual investor limits prevents the AI expansion from having impact.

Congress’s Reg CF individual investor limit exemplified bad drafting.

As enacted in Title III of the JOBS Act, Reg CF individual investor limits reads:

[T]he aggregate amount sold to any investor by an issuer, including any amount sold in reliance on the exemption provided under this paragraph during the 12- month period preceding the date of such transaction, does not exceed— ‘‘(i) the greater of $2,000 or 5 percent of the annual income or net worth of such investor, as applicable, if either the annual income or the net worth of the investor is less than $100,000; and ‘‘(ii) 10 percent of the annual income or net worth of such investor, as applicable, not to exceed a maximum aggregate amount sold of $100,000, if either the annual income or net worth of the investor is equal to or more than $100,000

Like most statutes this passage shows how lawmakers should not write laws. Congress could have defined a hard limit adjusted for inflation for non-AIs and no limit for AIs. Instead, Congress divided the Reg CF limit into four categories: (i) 5% of annual income; (ii) 5% of net worth; (iii) 10% of annual income; and (iv) 10% of net worth. Then it added a floor, $2,000 and a ceiling, $100,000.

It gets “better.” Congress failed to specify when each limit applies. Part one states, “if either annual income or net worth is less than $100,000 and part two states “if either the annual income or net worth . . . is equal to or more than $100,000.” So which is it? If someone’s income was $150,000 and net worth was zero, he would qualify for both brackets. And once in the bracket which limit applies, annual income or net worth? In the previous example if placed in the 5% bracket the limit would either be $2000 or $7,500.

The SEC interpreted Congressional ambiguity in the worst possible way

Congress tasked the SEC with writing the Reg CF rules and cleaning up its textual mess. In its typically chary way, the SEC chose the worst possible interpretation. First it declared investors must meet the $100,000 threshold for both income and net worth for the 10% bracket. Second it chose the lesser of income or net worth once placed in either bracket. Thus, is the previous example the rules limited the $150,000 salaried person with no net worth to $2,000.

The Commission originally proposed the greater of standard but changed course because of the supposed greater equity crowdfunding risks:

We recognize that this change from the proposed rules could place constraints on capital formation. Nevertheless, we believe that the investment limits in the final rules appropriately take into consideration the need to give issuers access to capital while minimizing an investor’s exposure to risk in a crowdfunding transaction.

Importantly, the Commission also declined to exempt AIs from the formula. This distinguished Reg CF from Reg D and Reg A+ where accredited investors face no caps.

Equity crowdfunding continues to flourish despite bad drafting and regulatory hurdles

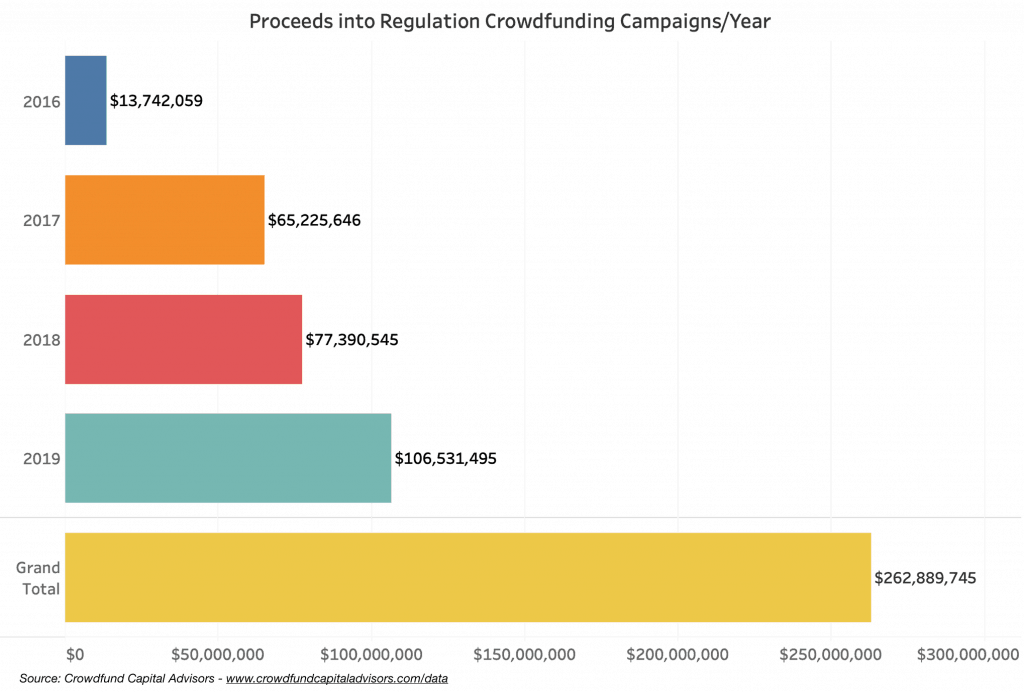

Despite government obstacles equity crowdfunding continues to grow. In arguing against expanding the AI definition a group of state attorneys general cited Reg CF underuse as evidence for restricting AIs.

[T]he equity crowdfunding market . . . has largely been underwhelming expectations despite significant deregulation to allow individual investors all along the financial spectrum to participate. Instead of a booming marketplace, equity crowdfunding has remained a niche market with fundraising falling well below the statutory caps and issuer-generated maximum targets for their offerings.

The AGs don’t mention the Commission-led barriers placed in Reg CF’s path, including confusing investment limits. Nonetheless after a slow start Reg CF has gained substantial ground in the past two years. According to Crowdfund Capital Advisors Reg CF investment jumped 37% between 2018 and 2019.

Equity Crowdfunding portals are having a record year

Further massive Reg CF portals SeedInvest and Wefunder have reported their best months ever in 2020. And despite endless handwringing from regulators, academics, and nonprofits, Reg CF has not experienced predicted fraud and high-risk speculative investments. The Commission admits as much in its 2019 review of the exemption’s performance:

During the considered period, there were few instances of legal proceedings (involving FINRA or the Commission) referencing Regulation Crowdfunding, so we cannot infer a systematic relation between any particular characteristics of the offerings and the incidence of such legal actions. In particular, a search of publicly available information in the Commission’s litigation releases has not identified civil complaints or administrative proceedings filed against Regulation Crowdfunding issuers or intermediaries. We have, however, identified four actions initiated by FINRA against a funding portal member that involved alleged violations of Regulation Crowdfunding or FINRA rules.

The Proposed Rules along with the expanded AI definition will improve equity crowdfunding

Equity crowdfunding seems poised to become a “booming marketplace” with the expanse of time and more favorable rules. Four years after a decidedly jaundiced Commission wrote Reg CF’s rules it has finally proposed improvements. One proposal seeks to correct its individual investment-limit mistakes. First it has proposed switching to the originally proposed “greater of” standard. Also, it has finally proposed lifting the caps for AIs. Assuming the Commission adopts the proposals as is, more equity crowdfunding investors will be free to invest without limits. This will further enhance Reg CF’s attractiveness to issuers and investors alike inching it toward the “booming marketplace” of state AG dreams.