Are changes coming to Reg CF?

Regulation Crowdfunding (Reg CF) is helping small businesses and startups across a broad range of demographic and geographic cohorts. But some tweaks could make it even more appealing for founders. So concluded the Securities and Exchange Commission Office of the Advocate for Small Business Capital Formation (the SEC Advocate) in its recently released annual report.

Reg CF allows private companies to accept investment from its own “crowd” of supporters, friends, customers, clients, and anyone else, without the wealth requirements that have traditionally limited investment to Accredited Investors.

Since going live in 2016, Reg CF has successfully opened private markets to companies in a vast array of industries. It has also become “social validation” for venture capitalists less eager to write large checks than they were a few years ago.

Reg CF is helping a broad array of founders

Founders across the spectrum are incorporating this tool into their capital-raising portfolio. The SEC Advocate reports:

- 28.5% of offerings in Q3 2022 had at least one woman founder

- 25.2% of offerings in Q3 2022 had at least one founder of color

- 71.5% of offerings in 2022 exceeded minimum funding targets

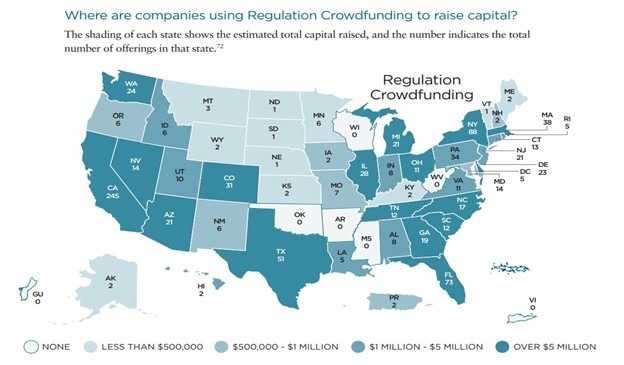

- 70% of capital is distributed outside the top 10 capital hubs

- $1,578 average investor check size

- $428,486 average raise in 2022

Still, Reg CF comprises only a small part of the overall private capital market. The SEC last modified Reg CF in 2021, raising investor and offer limits, allowing Special Purpose Vehicles (SPVs), which cabin Reg CF investors on a single cap table line, and allowing pre-raise communications with potential investors. These fixes made Reg CF more founder and investor friendly.

Are Changes Coming to Reg CF?

The SEC Advocate now recommends additional changes to further this effort. They include allowing non-GAAP accounting for small businesses raising up to $500,000 to satisfy financial requirements and increasing the offer ceiling on for financial self-certification. Currently, for offerings between $124,000 and $618,000, or for the first Reg CF of up to $1,235,000, the issuer must provide GAAP-based CPA-reviewed financial statements.

They also propose allowing companies operating under the Investment Companies Act to utilize Reg CF. The SEC Advocate asserts this would smooth existing complications with the SPV model.

The full Commission will consider these recommendations along with the others the SEC Advocate recommended to help small business capital raising.

Regardless of whether the SEC acts, founders should be weary of the myriad legal pitfalls they potentially face with Reg CF. It is always best to engage legal counsel before undertaking any securities transaction, but especially those with retail investors. The SEC is especially protective of these less sophisticated investors in contrast to exemptions where only Accredited Investors are eligible.

Reg CF changes means hiring expert counsel

Founders should hire experienced counsel to guide them through the process. The original SEC Regulation Crowdfunding release is almost 700 pages and the commission has added guidance and interpretations several times. Moreover, the SEC Enforcement Division is ramping up scrutiny on Regulation Crowdfunding.