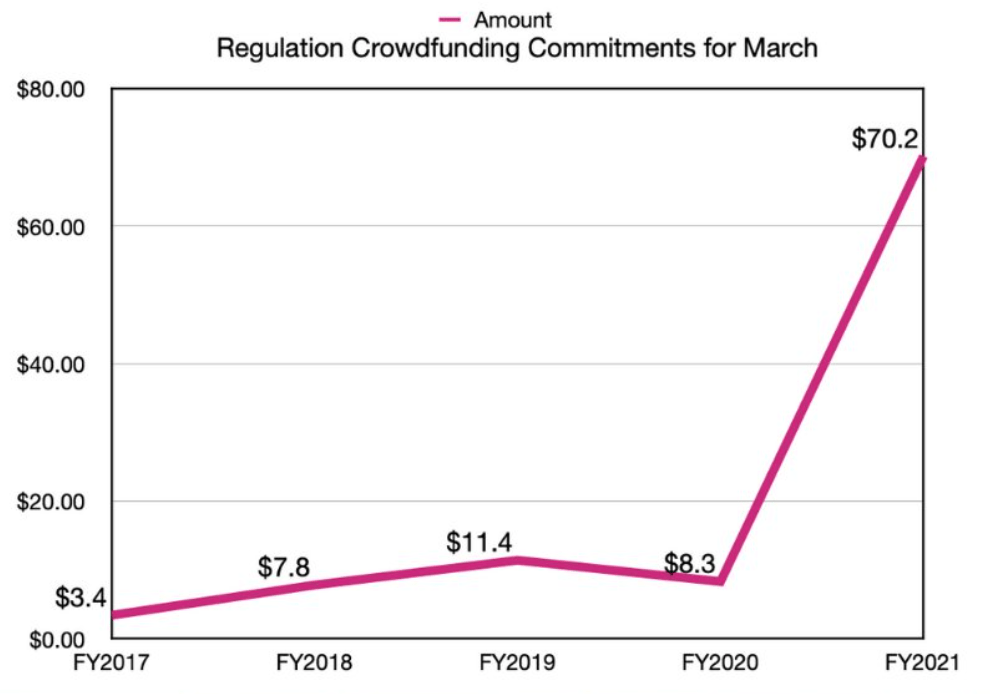

Equity crowdfunding (Reg CF) exploded in 2020 setting records for new investors and capital raised. New rules begun in March will mean even more records as companies can offer, and investors can devote, more per raise.

Source: Crowdfund Capital Advisors

But as more founders find Reg CF, many will err in portal choice. It’s understandable. Portals are the “face” of Reg CF, where companies pitch themselves to potential investors and interested backers peruse deals. They are offer value by facilitating the securities transaction and exposing companies to scores of potential investors.

But all portals are not created equal. For a variety of reasons many companies will choose the wrong one and leave money on the table. Experienced counsel can guide new companies through every step of the raise, including portal choice.

Here are eight reasons companies should retain a lawyer before choosing an equity crowdfunding portal.

- Portals secure their bottom line before founders’ top line.

- Different portals have different strengths, different fee structures, have different geographic profiles, have investor lists geared toward different industries, and place varying pre-raise scrutiny levels on companies.

- Naturally, their primary concern is attracting as many quality companies to their site as possible. Their main selling point is their investor list. Thus, the better companies they attract, the more investors those companies will provide them, the more their investor list grows.

- No portal is going tell a good company ‘You’re great but we aren’t the best portal for you because of X, Y, and Z.’ But a lawyer who understands each portal’s strengths and weaknesses will.

- Portals may have ‘Preferred Partners’ that may charge above market prices for ancillary services.

- Depending on a company’s offer limit, security type, and how much ‘crowd’ it can self-generate, it will need other professional services such as a CPA, transfer agent, or marketing.

- A portal may have side deals with these professional services that may charge above market rates. Novice companies may pay more for less.

- Experienced crowdfunding lawyers can provide warm introductions to portal representatives.

- An experienced lawyer should provide a personal introduction to portal representatives. This allows a company to bypass an impersonal website application and talk to portal staff before making a final decision.

- Good lawyers have their own networks of potential investors and signal boosts to help the raise.

- Lawyers should be as committed to the raise as the founders. That means sharing the raise to their networks, signal boosting updates, and raising awareness on social media. Equity crowdfunding is a team effort, everyone must contribute.

- Reg CF lawyers will discuss the intricacies of financial instruments with the founders and tailor it to fit the company and raise.

- Many founders choose a portal-provided template for the company’s financial instrument without understanding it. Portals sometimes prefer these premade templates because it standardizes raises.

- But what is easy for the portal is not necessarily best for the company. Many factors go into choosing which financial instrument is best and each has parts founders must separately consider or modify. One size does not fit all.

- Even on relatively straightforward instruments like Simple Agreements for Future Equity (SAFEs), calculations, valuations, and discount rates can vary widely. For instance, most founders won’t know the difference between a pre-money SAFE and a post-money SAFE, or which is more founder friendly. A portal representative is not going to explain it (if they even know themselves).

- Lawyers protect companies in the ‘Risk’ section.

- ‘Risks’ provided by portals are usually boilerplate that appear on almost all Form Cs. Portals will not spend the time and effort to get into specific risks the raise will encounter particular to the founder’s business or industry.

- Hopefully the raise and business succeed so what risk disclosures the Form C lists won’t matter. But the more specific and tailored to the raise the risk disclosures are the more protected the company is from future litigation should something go wrong.

- Experienced lawyers can draft suggested answers for investor questions during the raise and keep founders compliant both inside and outside the portal.

- An important part of Reg CF raises are questions potential investors ask founders on the portal page. Some questions are business-centric about revenue and future plans etc. These are best answered by founders. But many involve legal questions about securities, the Form C, and other complex topics where founder won’t be versed. Legal counsel can draft answers that keep founders compliant and stop them from saying (or promising) things that can produce liability.

- Lawyers will also review founder communications and marketing outside the portal to keep companies compliant with Reg CF’s myriad communication rules.

- Lawyers represent the founders, no one else. The company’s lawyer has one focus during the raise. They are the only ones in the process who’s only job is to protect the company’s interests. Good ones will not only keep founders compliant but maximize the raise. With potentially millions of dollars at stake, it pays to have someone in your corner.

As decentralized finance and equity crowdfunding explodes in popularity, founders should engage legal counsel to guide them through the process and allow them to focus on what matters most: getting capital to grow their business.