Equity crowdfunding keeps gaining on other forms of capital raising despite (or perhaps because of) capital-raising headwinds. The pandemic, economic uncertainty, and the tumult of an approaching election has gripped America with anxiety.

Not so with equity crowdfunding as it gains acolytes and breaks records seemingly monthly. Wefunder, the biggest equity crowdfunding portal volume, reported its three biggest months ever as March, April, and May of this year. Now Crowdfund Capital Advisors, which curates equity crowdfunding data reports:

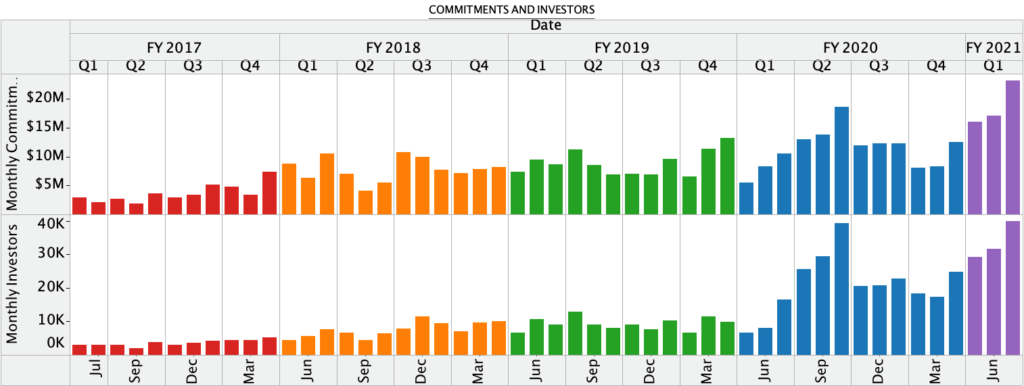

- July was the highest month of investor commitments at $23.2 million. The next closest month was October 2019 with $18.5 million. (See chart below)

- June and May of this year were the third and fourth highest months of commitments.

- The first quarter of this fiscal year saw more commitments than the entire first year of Regulation Crowdfunding.

Proposed SEC rule changes could help equity crowdfunding gain traction

Equity crowdfunding will likely keep gaining even under prolonged uncertainty. In March, the Securities and Exchange Commission proposed several changes to Regulation Crowdfunding that will increase use. As I explain in an upcoming law review article, the proposed measures fall short of the best possible Commission fixes. But, if enacted as is, it would improve the equity crowdfunding landscape for entrepreneurs and small businesses.

For now, as many people spend lots of time home-ridden, some are looking for investment opportunities. In equity crowdfunding, everything is transacted over the internet and potential investors can view financial and legal documents and query founders before investing. The equity crowdfunding ride is only just beginning.