DeFi is rising and stumbling as early adopters capture decentralized finance’s potential and some lose their shirts in untested protocols. So, what is DeFi and how can it change the way global finance happens without a deluge of lawsuits from foolish risktakers?

DeFi dApps (decentralized applications) can perform limitless financial functions. They include lending and borrowing money, no-lose lotteries, and high stakes rigged “games” where rule-knowing insiders fleece FOMO come-latelys. The dApps run on smart contracts that in theory need little human oversight. They operate through preset coded triggers and on permissionless blockchains. As a concept Defi can remove middlemen from potentially every financial transaction, anywhere globally. It also creates the possibility for new financial protocols or “games” to arise as coders build different apps like Legos.

On the bright side, bloated governments and centuries-old financial institutions need not play the role of trusted go-between. Contracting parties need not know each other and most of the time they will not. Removing middlemen means removing the middleman fees ensuring more profit for both parties—at least when working as designed.

DeFi is rising through adoption.

DeFi started from a 2018 Meetup. It progressed in the fall of 2019 but really exploded this summer. According to Defi Pulse, since June the “TVL” in DeFi dApps has grown from $1 billion to almost $7 billion. TVL or Total Value Locked is the amount locked in DeFi apps.

DeFi rises because it is infinitely composable.

DeFi dApps’ programmability yields unlimited potential for common financial transactions. But also for unbridled fervor in younger enthusiasts hoping for instant riches. Because DeFi dApps run on unmanaged smart contracts, embedded triggers direct their actions. If the code is solid little need for human oversight arises. The code is transparent so anyone can audit or find bugs but also that transactions are public and traceable. DeFi dApps are global open to anyone with an internet hookup or smart phone. They are permissionless; anyone can join or leave a DeFi dApp at any time. Finally, and most revolutionary, they are interoperable. Programmers can build, rebuild, or “compose” them in infinite ways. Creativity depends only upon people’s willingness to place their money in new (often untested) configurations.

DeFi is rising through useful applications that excise middlemen

Coinbase lists several different uses that have caught on in nascent DeFi:

Stable coins

Maker is a stablecoin project where each stablecoin (called DAI) is pegged to the US Dollar. Stablecoins offer the programmability of crypto without the downside of volatility of “traditional” cryptocurrencies like Bitcoin or Ethereum.

You can try creating your own DAI stablecoin on the Maker Oasis dapp. Maker is more than just a stablecoin project, though–it aspires to be a decentralized reserve bank. People who hold a separate but related token, MKR, can vote on important decisions like the Stability Fee (similar to how the Federal Reserve’s Federal Open Market Committee votes on the Fed Funds rate).

Another stablecoin with a different architecture is USD Coin (USDC), where every USDC token is backed by one US dollar held in an audited bank account. LINK

Lending

Compound is a blockchain-based borrowing and lending dapp — you can lend your crypto out and earn interest on it. Or maybe you need some money to pay the rent or buy groceries, but your funds are in your crypto investments? The Compound contract automatically matches borrowers and lenders and adjusts interest rates dynamically based on supply and demand.

Prediction

Augur is a decentralized prediction market protocol. With Augur, you can vote on the outcome of events, except you put ‘skin in the game’ by attaching a value to your vote.

Games

The composability of DeFi lends itself to infinite new possibilities. PoolTogether is a no-loss game where participants deposit the DAI stablecoin into a common pot. At the end of each month, one lucky participant wins all the interest earned, and everyone gets their initial deposits back. LINK

Yield Farming can foment a DeFi revolution

DeFi’s biggest attraction is the chance to gain additional dApp-provided tokens as an incentive for use. Users “farm” these additional tokens at no additional cost, risk, or effort. This is essentially free money subject to the limitations of placing enough money in the dApp to make it worthwhile and account for the transaction fees inherent in traversing dApps.

DeFi stumbles (and the rise of degens)

Like any tech breakthrough Defi is plagued with uncertainty, faulty mechanics, wild speculations, immature systems, and eye-popping gains and losses. YAM shows the risks of plunging into uncertain dApps some of which have not even been audited. YAM was a protocol that pegged its value to the dollar. At defined intervals, the protocol would ‘rebase’ into dollar value creating an opportunity for insiders to reap huge profits if they ‘played’ correctly. But the YAM code had not been audited and the creators discovered a bug too late. YAM total value went from $60 million to $0 in about 35 minutes.

YAM boosters were part of a cohort known as the DeFi degenerates, or degens. Degens jump from one Defi protocol to the next without regard to due diligence or examining the risks. The point for the degens is to game the game by knowing the inside rules and get out before the project crashes.

Hackers gonna hack

Hacks are also a major concern. Hacks have been part of crypto from the beginning most notably the infamous 2016 DAO hack that began the Securities and Exchange Commission on the enforcement path.

Finally, more sophisticated operators can send spam bots geared toward attaching and profiting off major ETH transactions. This scam known as ‘backrunning” can clog up the ETH transaction que and waste millions of dollars in gas fees.

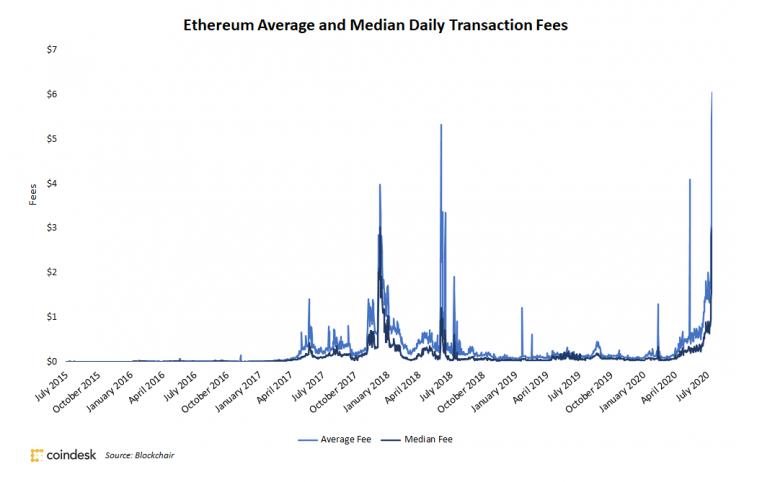

Even without backrunning DeFi’s has meant massive ETH gas prices. While ETH 2.0 or a competitor like OMG Network can solve some of these problems real fixes are months away and can themselves open up avenues for new problems.

DeFi will rise but many will likely lose in the process

These issues expose an obviously immature but growing market for decentralized financial applications. Some that have little value unless one is prepared to risk large amounts. Compound for instance yields only around .15% APY for ETH lenders. Other currencies pegged to the dollar like Dai have better returns but lending ETH without putting substantial upfront commitment will lose money given the transaction fees not to mention hack risks. Growing pains happen and will likely not distract from DeFi’s overall promise, but until maturation users should know the risks that go with the potential rewards.