Whales may be manipulating ETH prices according to financial analyst Adam Cochran. Cochran manually audited the top 10,000 Ethereum addresses and got some interesting results including possible ETH price manipulation. ETH is quickly becoming the world’s dominant cryptocurrency.

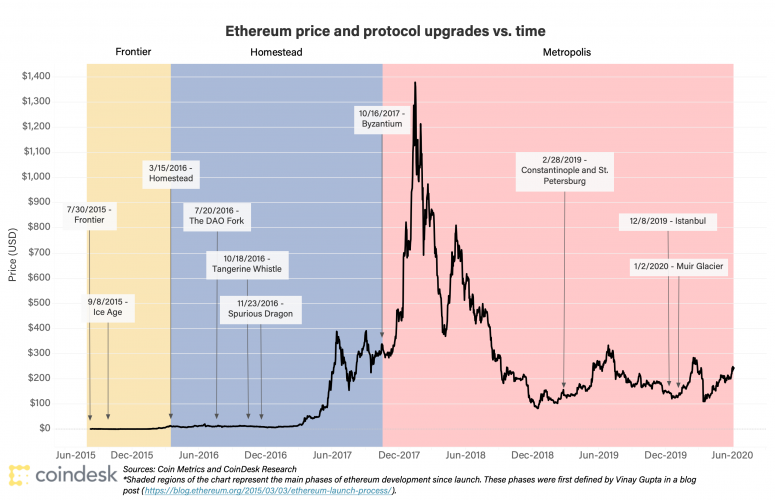

Although ETH price has steadily risen since “Black Thursday,” March 12, 2020, previous cyclical dips had occurred at the end of both 2018 and 2019 among other times where prices fell just above $100.

Twelve Whales short ETH before price drops

Cochran claims twelve whales work in conjunction with crypto exchanges BitFinex and possibly BitMex to manipulate ETH. First the whales begin shorting ETH. Their transactions are small enough not to trigger monitors like Whale Alert. Next a wave of bot-driven negative ETH traffic appears on Twitter. Select Asian and European whales move money into other currencies like DAI and USDC before the negative tweet storms happen. According to Cochran the shorts predict the drop 87% of the time and spend the next month cleaning up their haul as the ETH market rebounds. More suspicious BitFinex cold wallets predict the movements roughly 40% of the time. This doesn’t work all the time perhaps as little as 7% of the time but it doesn’t need to work often to make it work well. Bots apparently run by these whales encourage ETH FUD and then profit leaving the market guessing.

Growing popularity may prevent future ETH manipulation

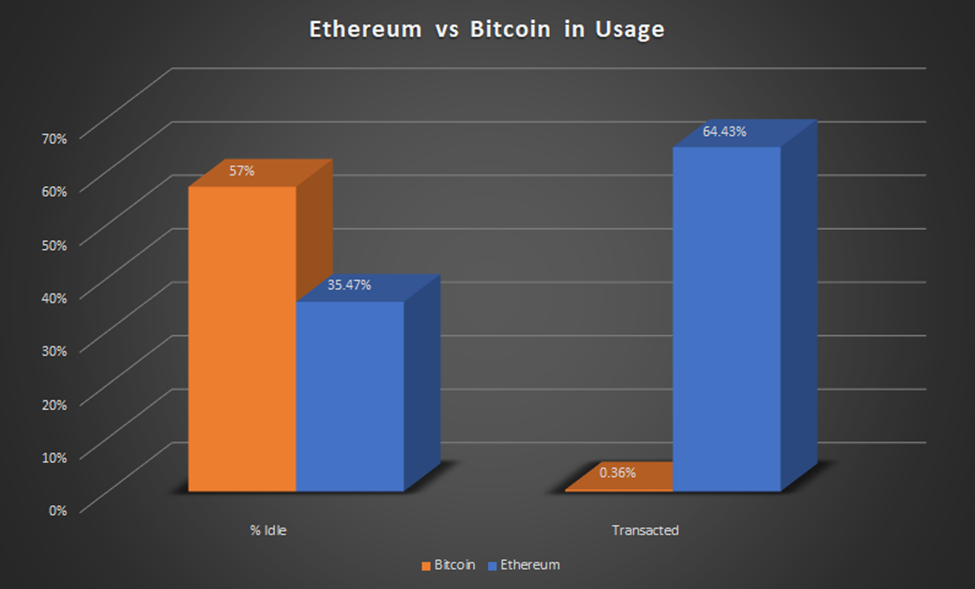

The booming advance of Decentralized Finance (DeFi) and the coming staking change with ETH 2.0 may grow ETH usage to a point these manipulations no longer happen. ETH’s long predicted overtaking of BTC as the world’s dominant cryptocurrency is well underway. Last spring whales purchased more ETH in six months than BTC in an entire year. But that didn’t stop it from being transacted much more frequently. ETH is used 440x more than BTC for transacting. Unlike BTC Hodlers, ETH is actually used, it is money.

As DeFi and other dApps gain adoption this trend will only continue. The influx of millions of new users interacting with ETH may prevent market manipulation while nurturing growth. Still, watch for another price drop in December.

By Jossey PLLC