Reg CF

Reg CF

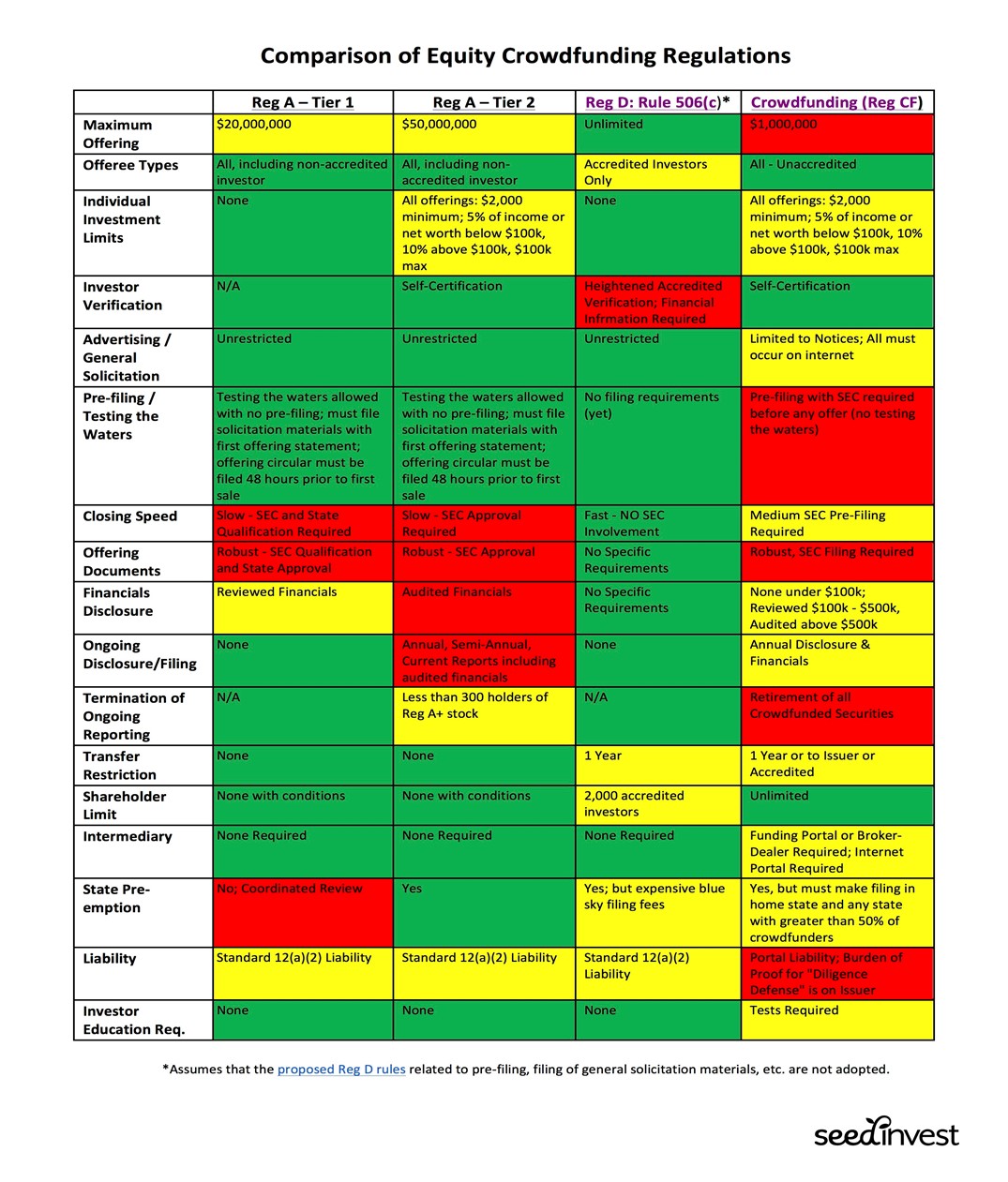

President Obama signed the Jumpstart Our Business Startups (JOBS) Act in 2012 after receiving overwhelming bipartisan support. The equity crowdfunding law helps startups and smaller businesses raise capital through innovative rules and regulatory rollback. Reg CF was finalized in May 2016.

Reg CF Basics

- Any business can raise up to $5M over a 12-month period selling shares, warrants, or bonds, and can set a minimum and maximum range

- Businesses sell their financial instruments over a FINRA-approved portal, 37 total portals, the biggest ones are located in California.

- Investors are subject to limits based on income and net worth, and usually must hold the investment for one year

- Businesses are required to track financial instruments and file a year-end report

Reg CF So Far

- Total Commitments: $217,383,649 raised since May 2016

- Total Investors: 234,883

- Total Campaigns: 1,640

- Average Raise: $219,382

- Jobs Supported: 8,690

Reg CF: Three Years of Growth

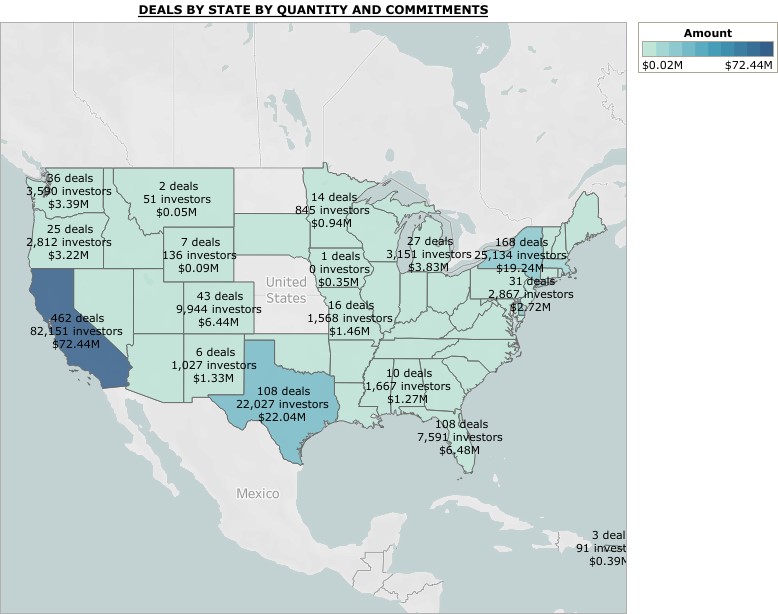

Growth by Geography

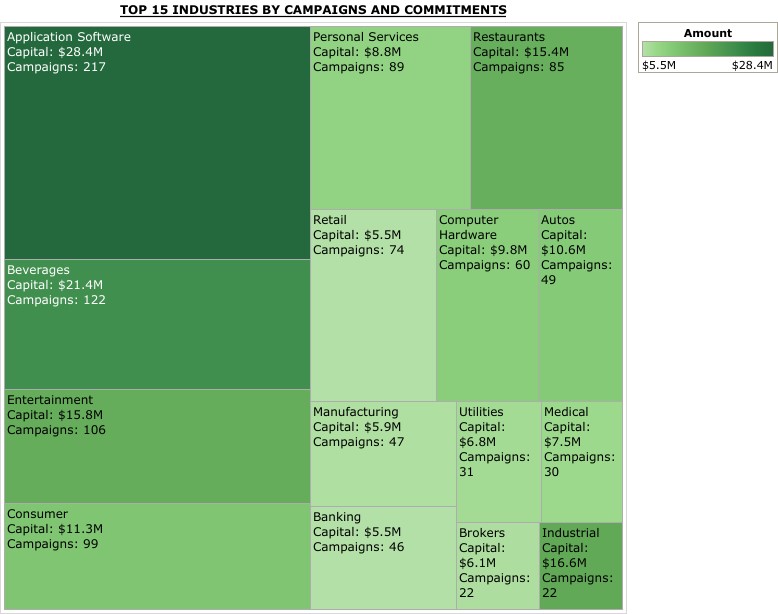

Growth by Industry

Successful Raise Realities

- Five major portals located almost exclusively in California

- Portal investors lists gives them all the power

- Look for criteria to determine probability of a successful raise.

- Revenue, Day 1 money, team, “cool” factor

- Lead investors ($50k), ambassadors, market traction, press generated

Future Reg CF Fixes

- Allow single-purpose crowdfunding vehicles advised by a registered investment adviser, which may mitigate issuers’ concerns about having an unwieldy number of shareholders and tripping SEC registration thresholds. H.R. 6380, Crowdfunding Amendments Act, JOBS Act 3.0

- Waive investment limits for accredited investors as defined by Regulation D.

- Increase the limit on how much can be raised over a 12-month period from $1 million to $5 million.

- Increase individual investor limits for nonaccredited investors of the greater rather than lesser of the annual income and net worth percentages

- Conditional exemption from Section 12(g) be modified by raising the maximum revenue requirement from $25 million to $100 million.

Is your company a good fit for Reg CF?

Disclaimer: This document is for informational purposes only. It does not represent a contract, offer, or any legal obligation on the part of JOSSEY PLLC. Many factors go into a successful raise including appeal of the product, market for the product, quality of marketing, operating history of the company, experience of management, and ability to self-generate crowd investors. Legal and regulatory compliance is only one part. Investing in small companies and startups carries lots of risk, there is no guarantee any issuer will have a successful raise.