The speaker list screamed. The SEC Investor Advisory Committee recently heard testimony on the proposed Concept Release on Harmonization of Securities Offering Exemptions. And the invitees shrieked irreverence for America’s innovators.

The majority talkers—academics, policy pushers, and regulators (Nannies)—played their part as innovation hurters, capital killers, and job jerkers. Startups, say the Nannies, must go through them for the privilege of driving the economy.

The SEC Investor Advisory Committee is typical Washington—formed through Dodd-Frank, a political overreaction to a downturn the government itself helped create. It holds hearings and recommends solutions to problems that may not exist to commissioners who may not read them. Its purpose is appearance and to provide some insiders a sinecure. The SEC Investor Advisory Committee is staffed with well-meaning academics and agitprops who never work where they play. But sincerity does not obviate uselessness.

Nannies and Doers presented different ideas about capital raising

Everyone knows capital-raising rules are unforgiving and prolix. And they limit the best prospects to the already moneyed. Thus, two solutions: (i.) allow everyone to invest in riskier but higher reward early-stage companies; or (ii.) force everything into the public markets or die.

The Nannies, Boston College professor Renne Jones (a veteran of such panels), policy hack Tyler Gellasch, state bureaucrat Andrea Seidt, knew the answer. Each spoke of rules, rules, and oversight. None ever signed the front of a business check. None ever will.

Worst was Mr. Gellasch, the neo-New Dealer. In a bygone era, his likeness walked confidently behind Rexford Tugwell or Henry Morgenthau. Full of bravado, confidence, and self-assured in his ignorance. The only thing missing were the wingtips and zoot suit.

Gellasch was the guy 90 years ago telling Americans he could fix things; he and his pals were the smart ones. So smart, it turned out, they took an 18-month downturn and made a 10-year calamity. And left us with a permanent bureaucratic ruling class as the tax we pay for being Americans.

The Doers gave the SEC Investor Advisory Committee needed insight

Standing apart were angel investor Catherine Mott, and compliance CEO Sara Hanks (the Doers). The difference between the two groups is stark. The Nannies look at reports, attend conferences, and think of new ways to control those they study and regulate.

The Doers think in ideas. How to solve problems. This is hard work. Entrepreneurs give their lives to work, knowing the odds aren’t good. Some spend years at or near bankruptcy before success. Gains bring the Nannies’ watchful eyes. The Nannies never know failure (or success) because they never try. Their realm is not ideas but rules and rulers, and obedience to both.

Ms. Mott’s testimony was compelling. She fights the geographic opportunity gap. What happens when a Western Pennsylvania factory shutters? Can a Mississippi startup get a chance with current rules? Right now, Ms. Mott says no. The morass of rules and the zeal to enforce them overpowers outsiders. The money, says Ms. Mott, is looking elsewhere and America loses as a result.

Entrepreneurs get tripped up by regulations and can lose the opportunity to create an impactful enterprise. Harmonization of rules in a balanced fashion can facilitate innovation in the United states. When all net new jobs in the United States are created by companies five years old or less it behooves us to pay attention to the issues for real economic development purposes. Furthermore, China has gained significant ground at a remarkable rate in advancing innovation and encouraging capital investment in startups. The United States is falling behind.

Investor Advisory Committee gives short shrift to the difficulty following SEC rules

Ms. Hanks runs a company that helps startups with rules but even she gets flummoxed. Speaking of solicitation: “Nobody knows what it is, nobody can work out what the rules are. We waste so much time trying to comply with it when we should be trying to work out what information people need at the time of sale.”

Later she defended the much-maligned Reg A+ after Gellasch (of course) insisted it wasn’t working:

I just want to defend Reg A. So, the listing companies right now when I counted this morning there was nearly 600 filings that have taken place under Reg A. Some of them did not qualify because they were crappy. Some of them withdrew because no one was interested in investing because they were crappy and that’s the way the markets work. Of the 600 or so, roughly 6 went to the listing markets and they didn’t do well and a lot of this is because of let’s say optimistic pricing. A lot of it is the whole process and some of these companies may not have been ready to become fully listing companies.

But to take that half dozen and say that’s your data point for disaster or not is to ignore an enormous number of companies who have really nice business plans, who have managed to raise some funds and employ people and are eventually going to come to the public markets we hope. . . . So, I think it’s a little unfair to take a whole category of companies and say they’re all disasters based on the performance of six companies.

Despite what SEC Investment Advisory Committee Nannies say, the private markets are working

America’s private markets are the envy of the world, accounting for $2.9 trillion dollars in investment last year.

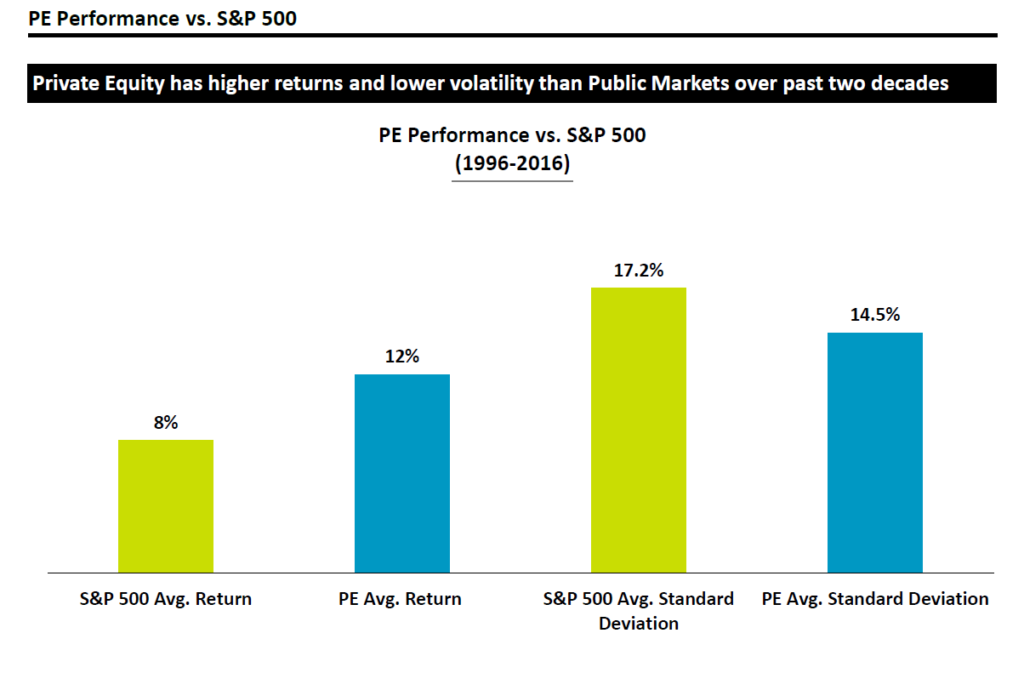

The further fact is that private investment has outperformed public markets over the past two decades and have lower volatility.

The Nannies hate this because private raises avoid the compliance cabal, quarterly reporting, activist shareholders etc. Being a public company is hard and costly, that is why there are fewer of them. But the U.S. economy is doing fine. If the Nannies succeeded there would be less startups, less jobs, less investment. But more lawyers, accountants, and regulators. Many companies, especially those not in California, New York, or Massachusetts lose out.

By adumbrating their position, the Nannies entrench those who can afford the public play and keep others with better mouse traps out. It is an academic version of regulatory capture.

What the capital markets need is an open playing field in the private world and acceptance the 1950s economy is gone. Instead of forcing companies into markets where they cannot win, laws should help startups raise small-dollar private money to prove viability.

Whatever happens the economy will not move forward with the Nannies haranguing the Doers.