Reg CF a regulatory success at seven

In May, Regulation Crowdfunding (Reg CF or equity crowdfunding), an innovative law that opened the private capital markets to everyone, turned seven years old. In this short time, it has gone from regulatory stepsibling to regulatory success.

The journey has not been smooth.

From its start in the JOBS Act of 2012, critics including state and federal regulators, associations, and some politicians, attacked equity crowdfunding as an unwise and unneeded tool that would attract scammers whilst leaving John Q. Public holding the bag.

Indeed, the Securities and Exchange Commission so opposed Reg CF it took four years to produce the regulations, heaping loads more issuer requirements.

The SEC eventually saw Reg CF as a regulatory success

But after four years of relatively smooth sailing the SEC reversed course. In 2020, it acknowledged the predicted fraud tsunami had not occurred and loosened the rules, making the Reg more investor and founder friendly. This combined with rising interest in online investing because of the pandemic has meant seven years hence, Reg CF has become a regulatory success.

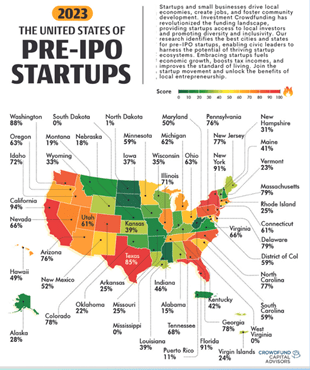

The numbers bear that out as curated by Crowdfund Capital Advisors (CCA).

- 1.7 million investors have invested over $1.8 billion into over 4,100 startups and small businesses across 1,700 cities in the US.

- Companies that have successfully raised via Reg CF are now valued at over $60 billion.

- Reg CF has contributed approximately $4.7 billion to the overall economy through salaries, inventory, rent, professional services, and various operational expenses.

Besides the raw numbers, Reg CF has performed a social good by allowing entrepreneurs access to capital who were traditionally outside the venture capital pipeline. According to CCA, “women and minority entrepreneurs (that routinely struggle to access capital) have had greater success within Investment Crowdfunding and are raising up to 50% of the capital.”

Securities professionals help keep Reg CF a regulatory success

But Reg CF critics weren’t completely wrong. As with any investment endeavor, there are risks for founders and investors. Founders new to the startup grind may overpromise, choose the wrong security, or fail to disclose material information to investors. Ordinary people investing in startups for the first time may not realize the mechanics of liquidity, valuation, or disclosures. And of course, many startups fail, and investments are lost. If not properly configured, founders could face liability from both investors and authorities. In 2021, the SEC brought its first charges against an issuer and funding portal alleging fraud.

That is why it is so important for Reg CF companies to hire counsel to guide them through the process, file the proper paperwork and advise founders on issues of portal selection, financial instrument, valuation, disclosures, investor communications, and more.

The Reg CF revolution is just beginning. As more companies realize the benefits of democratizing capital raising to include their loyal customers and brand ambassadors, the numbers will keep growing. As younger generations already accustomed to transacting online become founders and investors themselves, the days of wooing Silicon Valley VCs in haughty boardrooms instead of one’s own crowd on Twitter or TikTok may end.

Wherever the Reg CF journey goes, its best days are ahead.

By Jossey PLLC

Further reading:

Reg CF equalizes access to capital

Eight Reasons to hire a lawyer before a Reg CF campaign:

Bad Blood: Five Lessons for Startup Founders:

Venture Capital vs Equity Crowdfunding: https://www.thecrowdfundinglawyers.com/venture-capital-versus-equity-crowdfunding/