Once you’re ready to choose an equity crowdfunding portal you’re pretty far along the equity crowdfunding path. By now you’ve already decided that equity crowdfunding is right for your company. You’ve reviewed four keys to a successful equity crowdfund. And now you (and your lawyer) are ready to go portal shopping.

Indeed, the company must consider many factors in choosing an equity crowdfunding portal. And because portals sell 90% of equity crowdfunded securities the right “fit” is crucial. For instance, the biggest portal may not be best if your company will likely to mostly attract local investors. And a specialty portal may look great but if the investor list is skimpy, you’ll need to move on.

Thus, here are some considerations when choosing an equity crowdfunding portal

Federal and state equity crowdfunding portals; different strokes for different companies

To start, most companies look to the federal portals. To the extent equity crowdfunding has entered the public conscious its likely through Reg CF the federal exemption with the $1.07M limit. There are currently 45 Reg CF portals located throughout the country. But really only a few actually warrant consideration if you don’t have a massive ready-made crowd or marketing budget.

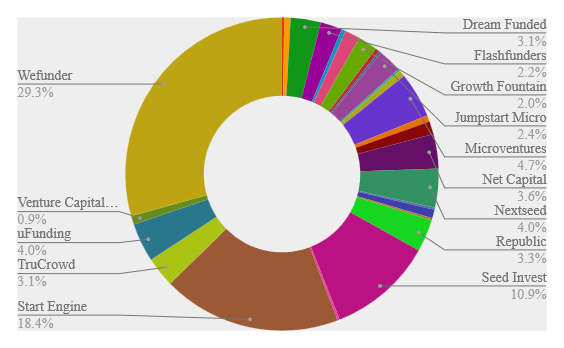

But really the market looks more like this.

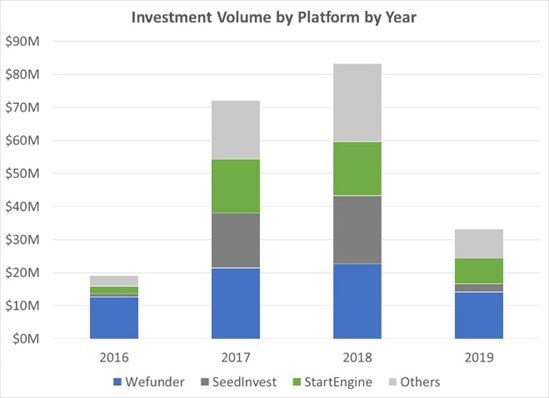

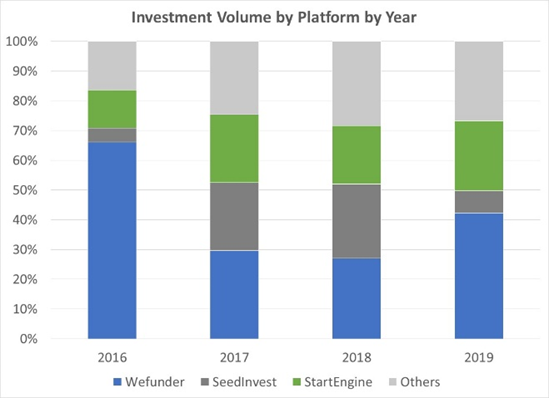

Thus WeFunder, Seed Invest, and Start Engine are industry leaders with Republic, and MicroVentures also having market share.

Companies should know that all but one of these is in California. So if you’re not West Coast think about what you can offer them as much as what they can offer you. Do you have cool technology? An interesting idea? A new approach to solving old problems? Be aware there is a supply and demand issue with the big West Coast portals because they have large investor lists you gain access to with acceptance on their platform.

Being in the South, Midwest, or East Coast is not necessarily a deterrent to acceptance. In fact, some portals stress they scout companies throughout the country. But be prepared to pitch!

If you choose a federal equity crowdfunding portal, be aware of the differences.

WeFunder: A great all-purpose portal with a massive investor list that has funded all sorts of startups with the top being Food & Beverage, Software, and Entertainment. And a soccer team!

Start Engine: A leader in the token/crypto space that accepts Bitcoin, has run its own token offering and is leading secondary-market development with their recent approval as an Alternative Trading System.

Republic: Part of a family of startup platforms together with AngelList and Product Hunt. “Mission driven” portal that also is a crypto leader. It was the first to do an air drop and has a unique Note Token digital asset.

Seed Invest which was bought by Circle last year and MicroVentures which split from Indiegogo are going through transitions but are still industry leaders.

Still other Reg CF portals remain as viable options. For example, TruCrowd a Chicago-based portal has also developed three specialty portals https://musicfy.us/ (Music), https://cryptolaunch.us/ (Tokens), and https://fundanna.com/ (Cannabis). But current offerings are slim.

State-based portals can be a viable alternative to federal Reg CF equity crowdfunding portals

But not all companies are good fits for the big West Coast portals. For example, businesses that aren’t likely to scale, whose investors will mostly be local, or those with strong state appeal may be better staying in-state.

Although all investors must be state residents, these portals can offer advantages. 1. There is likely to be less compliance costs with a smaller regulatory burden and supportive state government. 2. Higher limits (although not always). This means one big investor can really jumpstart a raise. 3. Opportunity for localized wealth creation, and. 4. Less marketing costs.

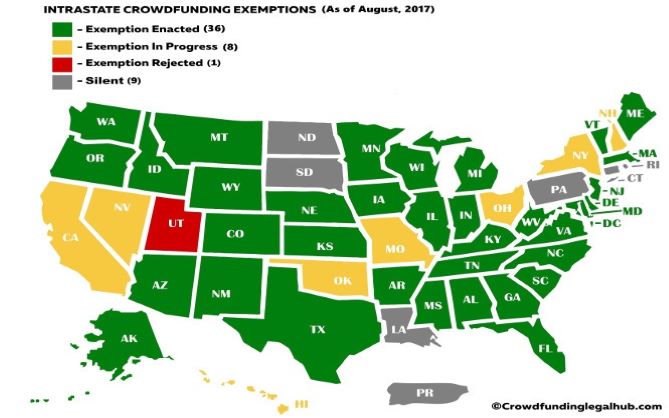

As of 2017 according to lawyer Anthony J. Zeoli most states had already approved state portals or were in the process.

For a list of state-crowdfunding rules see here.

And at least one innovative platform has combined the two. Silicon Prairie offers a Reg CF portal along with state-based portals in Michigan, Iowa, Minnesota, and Wisconsin where state limits are as high as $5 million.

Your equity crowdfunding portal choice will factor into your raise’s success

Sherwood Neiss, principal of the analytics firm Crowdfund Capital Advisors, estimates the next two years will bring 3,400 companies, half a billion dollars, and over half a million investors into the equity crowdfunding world. And help from Congress or needed changes by the SEC would bring much more.

And as more companies take advantage of the opportunity, they will have to choose the right equity crowdfunding portal. Indeed, your choice of an equity crowdfunding portal will go far in determining the success of the campaign.

By Jossey PLLC via www.thecrowdfundinglawyers.com

Schedule a call or video conference

Disclaimer

This post is for informational purposes only. It does not represent a contract, offer, or any legal obligation on the part of Jossey PLLC. Many factors go into a successful raise including appeal of the product, competition for the product, the quality of the marketing, operating history of the company, experience of management, and ability to self-generate crowd investors. Legal and regulatory compliance is only one part. Investing in small companies and startups carries lots of risk, there is no guarantee your company will have a successful raise.