No one ever mistook SEC Chairman Jay Clayton for a daredevil. He didn’t spend his youth bungee jumping, drag racing, or venturing to the deep end of the neighborhood pool. In fact, he is the staid, strait-laced embodiment of the Machine: the credential-and-prestige obsessed cabal of East Coast lawyers and fancy-degreed personages that land each year at name-brand federal agencies to pilot the American economy while disclaiming responsibility for the results.

Increasingly those who did jump (literally and figuratively) —the risk-taking disruptors creating the new American economy—are complaining about Mr. Clayton’s stifling edicts. These daredevils include Circle founder and CEO Jeremy Allaire who recently laid off 10% of his workers blaming “an increasingly restrictive regulatory climate in the United States.”

Criticism of “Shallow-End Jay” is usually reserved for those “speaking on condition of anonymity”

A pusillanimous group of insiders are also panning “Shallow-End Jay” from the safety of anonymity. . After quoting several anonymous sources, Crowdfund Insider recently declared, “Some people believe that Chair Clayton simply wants to dodge a bullet and exit before the next election cycle hits in full force. He would prefer to end his tenure at the SEC minus any major catastrophes, imaginary or not.”

So “Shallow-End Jay” may be stalling the future of the U.S. economy to ensure the best possible post-SEC landing spot. Why settle for the sticky, dirty U. Penn when Harvard may call?

SEC’s failure to fix Reg CF has been glaring

Reg CF, which crossed year three this month is one area where SEC paralysis is blatant.

Reg CF was supposed to revolutionize small-business capitalization. Indeed, President Obama described it as a “game changer” when he signed the JOBS Act into law seven years ago. For the first time, the potential for massive returns would be available to everyone, not just a network of venture capitalists and investment bankers.

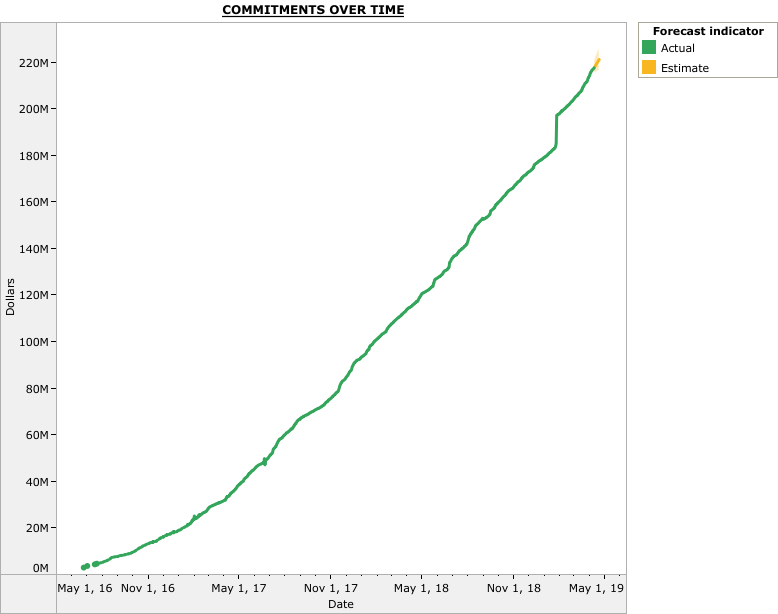

On the surface Reg CF seems to be performing swimmingly:

- Commitments: $217,383,649 raised since May 2016

- Investors: 234,883

- Campaigns: 1,640

- Average Raise: $219,382

- Jobs Supported: 8,690

But in reality, it’s sinking. And the dead weights are manifest and known within the trade media, the SEC, and the broader government.

In March 2017, Edward Knight, Executive Vice President and General Counsel of NASDAQ testified:

From the outset the SEC’s view of [Reg CF] was they were not for this they and made it, shall I say, needlessly complicated and did not approach it except as this this was something where the public is going to get harmed and we need to narrow it as much as possible.

Just six months later the U.S. Treasury recommended several improvements, but thus far neither the SEC nor Congress has acted.

“Shallow-End Jay” and the SEC may finally be acting

But help may be near. Corp Fin’s Bill Hinman recently acknowledged Reg CF’s shortcomings. Apparently, the SEC will soon publish its own Reg CF (and Reg A+) recommendations to increase their vitality and by doing so expand investment opportunity and brighten economic outlook. Yet the SEC can juice Reg CF with little effort. According to Mr. Hinman some of these reforms are on the SEC’s radar:

- Raise the limit from the nonsensical $1.07M

- Increase individual limits

- Remove the limit for accredited investors

- Relax the solicitation rules

- Allow Special Purpose Vehicles

- Allow CEOs to sign off on financial statements

These fixes would have a tremendous impact on Reg CF and still provide Shallow-End Jay a soft landing at the Harvard of his choice.