Crowdfunded revenue share loans hold promise for certain businesses raising capital during the pandemic. The SEC considered banning these Reg CF instruments along with other nontraditional instruments like SAFEs during its recent review and Final Rules vote. The Commissioners, however, kept them in Reg CF raises. (The Biden Administration’s plenary freeze on regulatory actions means the Final Rules are not yet live.)

Once the Final Rules go live, these instruments could play a bigger role in Reg CF funding. They offer the benefits of simplicity, flexibility, and brand loyalty.

Rev shares emerged in the early 20th century to finance oil and gas exploration. Eventually they spread to entertainment and startups. But they were not part of public financing provided by capital markets, thus few investors could access them. This changed with the JOBS Act of 2012 and Reg CF which went live in 2016. Now everyone, not just wealthy financiers, can participate in such projects and see immediate returns.

Brick-and-mortar businesses could benefit from crowdfunded revenue share loans

Crowdfunded revenue share loans are acutely suited for brick-and-mortar stores like restaurants, breweries, and bars. They also hold promise for other retail-based industries and subscription-based services.

How crowdfunded revenue share loans work

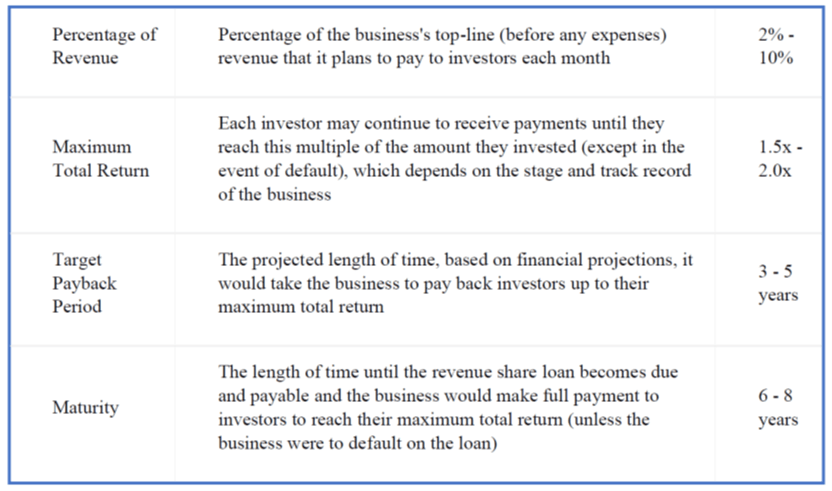

Like the name states, crowdfunded revenue share loans are crowdfunded loans (notes). Loyal customers and brand ambassadors will purchase these instruments first and hopefully spread the word. The company (issuer) pays a percentage of its top-line revenue to noteholders until it repays the debt. Payments vary with revenue—when revenue rises the issuer pays more and vice versa. If the issuer has not repaid the loan by the maturity date it becomes fully due and payable. Here are some standard loan terms:

Source: Localstake.com

Crowdfunded revenue share loans benefit both issuers and investors

Many advantages exist for issuers and noteholders using rev shares. First, they are easy to understand. Retail investors and loyal customers will buy these loans. This cohort will likely be unfamiliar with equity investments, for instance the terms, rights, and responsibilities of SAFEs or preferred stock. Issuers choosing these instruments are likely to have loyal and local followings and aren’t aiming for mass adoption where equity works better. Retail investors will see a return almost immediately and have the satisfaction of helping local entrepreneurs and boosting a local economy. Issuers avoid the complication of messy capitalization tables.

According to a 2018 study, issuers have more success with crowdfunded revenue share loans than other types of loans like bank or SBA loans. Bank loans will have higher interest rates and a greater chance bankruptcy. SBA loans are very selective, and processing takes many months.

Issuers can couple these rev shares with perquisites like with Kickstarter campaigns. Companies can provide T-shirts or other swag, exclusive deals, private receptions, or anything thematic to the business and raise. This will further strengthen their relationship and brand loyalty with customers.

Issuers and investors should consult professionals before investing

Of course, this blog post is not investment advice. As with any investment risks abound. The business could fail and default on the loans. Investors get no say in how the business operations. Issuers must accommodate potentially dozens (even hundreds) of note holders that may complicate accounting and tax structures.

Crowdfunded revenue share loans will not work for all companies, but it can be great for some. Congress designed Reg CF to help the millions of businesses ignored by venture capital. These instruments could further help them whilst strengthening brand loyalty. Provided the Biden Administration doesn’t unnecessarily delay the Final Rules, these rev shares could emerge as a Reg CF force.