What is Equity Crowdfunding?

The SEC finalized equity crowdfunding (Reg CF) regulations in May 2016. This innovative new law allows small businesses, entrepreneurs, and startups to raise capital through equity or debt sales to the “crowd” just as a public company could.

Reg CF Basics:

- Any business can raise up to $1.07M over a 12-month period and can set a minimum and maximum range

- Businesses sell their financial instruments over a FINRA-approved portal

- Investors are subject to limits based on income and net worth, and usually must hold the investment for one year

- Businesses are required to track financial instruments and file a year-end report with the SEC

Any successful equity crowdfund has three components: Legal, Accounting, and Marketing. A successful raise will usually require around $20K upfront and will be subject to portal fees after a successful raise.

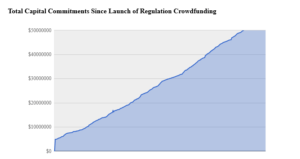

Equity Crowdfunding so far

As of August 14, 2017, businesses have raised $53,353,149 through equity crowdfunding.

Credit: Crowdfund Capital Advisors

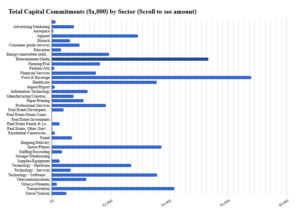

Credit: Crowdfund Capital Advisors

Almost 400 businesses have participated through 29 active portals. Businesses from a variety of sectors have utilized Reg CF with food and beverage, entertainment, sports, and transportation leading the way:

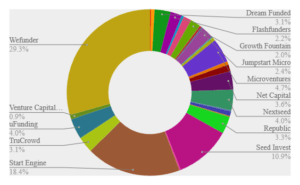

Credit: Crowdfund Capital Advisors

Certain portals have begun to separate themselves but it is very fluid and some outperform depending on the type of business.

Credit: Crowdfund Capital Advisors

Future Fixes:

Congress and the financial media have discussed several ‘fixes’ to make equity crowdfunding more dynamic, including the Reg CF provisions of the Financial CHOICE Act. While no guarantee any fixes will happen, many in Congress recognize the need for improvement. Some of the most discussed modifications are:

- Raising the annual raise limit to $5M or $10M

- Removing investment limits for accredited investors

- Removing or lessening the accounting burden

- Removing or lessening the solicitation rules

What Equity Crowdfunding can do for your business

Besides capital to help your business grow, Reg CF provides other benefits unique to this model.

- Broaden your investor base: Unlike other funding models, Reg CF can diversify your investor base from both a financial and geographical standpoint. Portals can accept investors from anywhere in the US, giving your business a potential foothold in all 50 states.

- Turn your customers into marketers: Reg CF allows your customers to become financially invested in your business and see their investment grow as your business grows. This provides a free marketing campaign for your business with every new investor.

- Incentivize your investors: Reg CF allows you to give out perks as part of the investment. Depending on the product this could include the product itself, ‘founder’ status on your website, access to events, or anything else that may induce an investment.

- Prove value to institutional investors: A successful Reg CF raise can show larger, institutional investors your business is ready for the big money. Many larger investors are now requiring “social proof” of a company’s business model. Your business can show larger investors value and momentum and provide your business “bridge money” while larger investors evaluate your model.

How Jossey PLLC can help capitalize your business

Pre-Sale:

- Handle all disclosures and regulatory compliance with the SEC. This includes your Form C, and any other legal issues

- Research the best portal for your product, make recommendation based on the best fit for your product

- Recommend a particular financial instrument and tailor the contract to fit your needs

- Review contracts, negotiate with vendors, recommend accountant and marketer

Live Selling:

- Free advertising and profile on my blog thecrowdfundinglawyers.com (approximately 2,000 unique visitors/month)

- On call for any legal, regulatory, compliance question you have usually get back with an answer in less than 24 hours.

Post Raise (additional monthly fee):

- Act as general counsel for your business. Answer any legal, regulatory, or compliance question that may arise. Review contracts, negotiate with vendors, and give general advice on employment and other business issues.

- Track your instruments: track any change of ownership throughout the year as required by SEC regulations.

- End of year report: Handle your year-end report as required by SEC regulations.

Disclaimer

This document is for informational purposes only. It does not represent a contract, offer, or any legal obligation on the part of Jossey PLLC. Many factors go into a successful raise including appeal of the product, competition for the product, the quality of the marketing, operating history of the company, experience of management, and ability to self-generate crowd investors. Legal and regulatory compliance is only one part. Investing in small companies and startups carries lots of risk, there is no guarantee your business will have a successful raise.

Jossey PLLC

(202) 779-5768