Equity Crowdfunding and the JOBS Act

President Obama signed the Jumpstart Our Business Startups (JOBS) Act in 2012 after receiving overwhelming bipartisan support. The equity crowdfunding law helps startups and smaller businesses raise capital through innovative rules and regulatory rollback. The SEC began implementing the law in 2013, finalizing the last title in 2016.

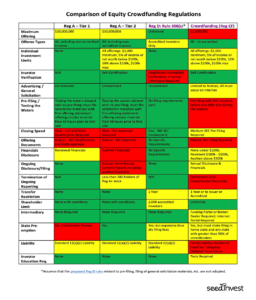

This memo focuses on three important changes the JOBS Act made to securities law: Reg A+, Reg D 506(c), and Reg CF. It explains how each has helped businesses capitalize along with changes the US Treasury suggests to increase their value and use. Finally, this memo explains how JOSSEY PLLC helps businesses with each regulation.

Reg A+

- Two-tiered crowdfunding mechanism that also serves as a public-offering onramp for smaller issuers

- Tier I: Issuers can raise up to $20 million from accredited and nonaccredited investors. Issuers have relatively small upfront accounting burdens during qualification but are subject to a state-level “coordinated review process”

- Tier II: Issuers can raise up to $50 million from accredited and nonacredited investors. Issuers face higher upfront accounting burdens but raises are preempted from state-level qualification (but not notice or fees)

- Issuers can “test the waters” to gauge interest without incurring substantial accounting or legal fees

- Financial instruments are unrestricted (freely tradable) although issuers may choose to impose contractual transfer restrictions and state-level ambiguity exists

Reg A+ So Far

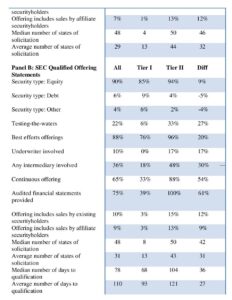

In the year after implementation (November 2016), 147 companies filed Regulation A+ offerings seeking $2.6 billion in financing. Of these, the SEC qualified approximately 81 offerings totaling $1.5 billion, 60% were Tier II.

The average size of the Reg A+ offerings was around $18 million, with most issuers having previously engaged in private offerings. Despite the increase from previous Reg A rules, Reg A+ issuers sought significantly lower capital amounts than issuers using other exemptions, such as Reg D.

Nonetheless, the Treasury Department recently stated, “Regulation A+ has enabled more companies to take advantage of the ‘mini IPO’ process than under the previously existing Regulation A registration exemption for small offerings. A Tier II offering may be less costly than an IPO, particularly for companies seeking relatively smaller amounts of capital.”

Reg D 506(c)

- Amended Reg D 506 into ‘b’ and ‘c.’ Allows general solicitation for Reg D offerings for accredited investors only

- Financial instruments are “restricted,” investors must generally hold them for one year

- Issuer must take “reasonable steps” to verify investor status as accredited

- Exempts from broker-dealer registration websites displaying Reg D offerings if profits derive from co-investment with accredited investors

- Notice filing with SEC and states, offers take form of private-placement memorandums

Reg D 506(c) so far

General solicitation has had a positive yet tiny effect on the private placement market. According to SEC data, for the approximately three-year period through the end of 2016, issuers raised $107.7 billion in debt and equity offerings under Rule 506(c); during the same period Reg D 506(b) issuers raised $2.2 trillion. Thus, Rule 506(c) offerings amount to only 3% of capital raised under Rule 506.

The availability of online marketplaces has had a positive effect: during the past three years, 16 online marketplaces have raised nearly $1.5 billion in over 6,000 private offerings for accredited investors.

Reg CF:

- Issuers can raise up to $1.07M from accredited and nonaccredited investors over a 12-month period and can set a minimum and maximum range

- Financial instruments are “restricted,” investors must generally hold them for one year

- Investors are subject to limits based on income and net worth

- Issuers sell financial instruments over a FINRA-approved portal (website)

- Issuers must track financial instruments and file a year-end report with the SEC

Reg CF so far

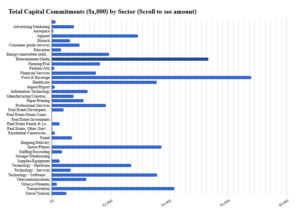

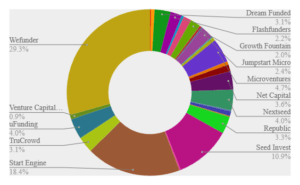

In the 12-month period following effectiveness (May 2017), 335 companies filed Reg CF offerings with the SEC and there were 26 portals registered with FINRA. Of the filed crowdfunding offerings, 43% were funded, 30% of campaigns ended unsuccessfully, and the others are still ongoing. Total capital committed was in excess of $40 million. On average, each funded offering raised $282,000 and included participation from 312 investors.

Businesses from a variety of sectors have utilized Reg CF with food and beverage, entertainment, sports, and transportation leading the way:

Source: Crowdfund Capital Advisors

Certain portals have separated themselves but it is very fluid and some outperform depending on the type of business.

Source: Crowdfund Capital Advisors

Future Fixes

In October 2017, the U.S. Treasury recommended changes for each regulation to increase use and value. Congress should consider these changes in Spring 2018.

Reg A+

- Expand Reg A eligibility to include Exchange Act reporting companies. This would provide already public companies with a lower-cost means of raising additional capital and potentially increase awareness and interest in Reg A offerings by market participants.

- Encourage state securities regulators to promptly update their regulations to exempt secondary trading of Tier 2 securities or, alternatively, have the SEC use its authority to preempt state registration requirements.

- Increase Tier II limit to $75 million.

Reg D 506(c)

- Encourage SEC, FINRA, and the states to propose a new regulatory structure for finders and other intermediaries in capital-forming transactions, “broker-dealer lite.”

- Amend the accredited investor definition to expand the eligible pool of sophisticated investors. The definition could be broadened to include any investor who is advised on the merits of making a Regulation D investment by a fiduciary, such as an SEC- or state-registered investment adviser.

- Review the Securities Act and the Investment Company Act provisions that restrict unaccredited investors from investing in a private fund containing Rule 506 offerings.

Reg CF

- Allow single-purpose crowdfunding vehicles advised by a registered investment adviser, which may mitigate issuers’ concerns about having an unwieldy number of shareholders and tripping SEC registration thresholds.

- Waive investment limits for accredited investors as defined by Regulation D.

- Change limits for nonaccredited based on the greater of annual income or net worth for the 5% and 10% tests, rather than the lesser.

- Increase the limit on how much can be raised over a 12-month period from $1 million to $5 million.

What Equity Crowdfunding can do for your business

Besides capital to help your business grow, equity crowdfunding provides other benefits unique to this model.

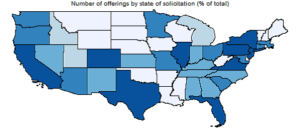

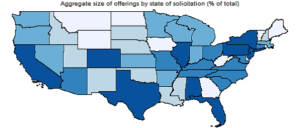

- Broaden your investor base: Unlike other funding models, equity crowdfunding can diversify your investor base from both a financial and geographic standpoint. Issuers can accept investors from anywhere in the US, giving your business a potential foothold in all 50 states.

- Turn your customers into marketers: Equity Crowdfunding allows your customers to become investors in your business and see their investment grow as your business grows. This provides free marketing for your business with every new investor.

- Incentivize your investors: Equity Crowdfunding allows you to reward investors with benefits thematic to your business. Depending on the product, this could include the product itself, ‘founder’ status on your website, access to events, or anything else that may induce investment.

- Prove value to institutional investors: A successful equity crowdfund raise can show larger, institutional investors your business is ready for big money. Many larger investors are now requiring “social proof” of a company’s business model. A successful raise shows larger investors value and momentum. It can also provide your business “bridge money” while larger investors evaluate your model.

How JOSSEY PLLC can help capitalize your business

Any successful equity crowdfund has three components: Legal, Accounting, and Marketing. A successful raise will require upfront fees and sometimes be subject to post-raise fees and ongoing SEC compliance.

Pre-Sale:

- Handle all disclosures and regulatory compliance with the SEC. This includes SEC Forms and qualification processes depending on the regulation

- Research the best vehicle for your business and product, make recommendations based on the best fit to maximize your raise

- Recommend a particular financial instrument and tailor the contract to fit your needs

- Review contracts, negotiate with vendors, recommend accountants and marketers

Live Selling:

- Free advertising and profile on thecrowdfundinglawyers.com (thousands of unique visitors/month)

- On call for any legal, regulatory, or compliance question you have; usually get back with an answer in less than 24 hours.

Post Raise (additional monthly fee):

- Act as general counsel for your business. Answer any legal, regulatory, or compliance question that may arise. Review contracts, negotiate with vendors, and give general advice on employment and other business issues.

- Track financial instrument changes in ownership throughout the year as required by certain SEC regulations.

- Handle legal review of SEC compliance reports as required by certain regulations.

Disclaimer

This document is for informational purposes only. It does not represent a contract, offer, or any legal obligation on the part of JOSSEY PLLC. Many factors go into a successful raise including appeal of the product, market for the product, quality of marketing, operating history of the company, experience of management, and ability to self-generate crowd investors. Legal and regulatory compliance is only one part. Investing in small companies and startups carries lots of risk, there is no guarantee any issuer will have a successful raise.

For further information and a free consultation, please contact:

JOSSEY PLLC

(202) 779-5768

thecrowdfundinglawyers.com