Equity crowdfunding’s first six months ended in December, the numbers are in and the outlook is promising. So far, the crowd has given entrepreneurs and business startups millions in funding, filling a crucial market gap. As the kinks are worked out crowdfunding will continue to expand and become a viable option for thousands more new and growing American businesses. But in just a half year the industry’s dynamism is already apparent.

Crowdfunding in all forms topped venture capital in 2016. The crowdfunding industry is doubling or more every year. As stated in a recent article, equity crowdfunding alone will surpass venture capital as the leading source of startup money by 2020 if it stays on the same trajectory.

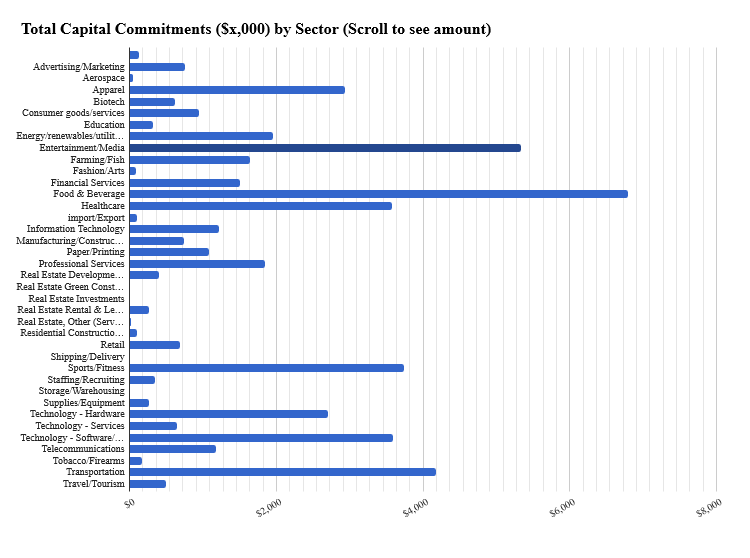

During the first six months businesses could take advantage of equity crowdfunding, 187 issuers made offerings, 24 were pulled leaving 163 asking for a total of $18 million. As of January 15, 33 offerings with year-end deadlines had closed receiving $10 million. Each month in 2016 brought an average of 22 new offerings over a variety of industries and through multiple portals.

According to the SEC, the average offering was targeting $110,000; the average scale of new offering activity on a monthly basis was approximately $2.4 million. Among those that reported non-zero total assets or sales in the prior fiscal year, the median asset growth was 15% and median sales growth 80% for the most recent fiscal year.

Early adopters were mostly small companies needing quick infusions of cash. About 40% of issuers reported non-zero revenue and 9% of issuers reported a net profit in the most recent fiscal year. Among issuers that reported non-zero assets in the prior fiscal year, the median growth rate was 15%. Thus crowdfunding is providing funds to new businesses that current markets weren’t servicing: startups and young businesses with relatively modest financial needs and lacking the sophistication or need for bigger offerings. Most issuers, 36%, opted for common or preferred equity. Debt accounted for 20%, and there were various other security types, such as units, convertibles, “simple agreements for future equity,” and others (including revenue sharing and membership / limited liability company (LLC) interests).

So what is exactly is equity crowdfunding?

It is part of the Jumpstart of Our Business Startups (JOBS) Act. Congress enacted this law on April 5, 2012. Title III of the JOBS Act amended Section 4 of the Securities Act of 1933 (Securities Act) and created a new exemption from registration for Internet-based securities offerings of up to $1 million over a 12- month period.

Here are the basics:

- A given issuer is able to raise up to $1 million across all crowdfunding offerings in a 12- month period. An issuer must raise at least the target amount to receive funds. Crowdfunding securities are generally subject to resale limitations for one year.

- The rules imposed limits on the amount that an investor can invest in all Title III crowdfunding offerings over a 12-month period. Investors with both an annual income and net worth of at least $100,000 can invest up to 10% of the lesser of annual income or net worth, but an investor’s total investment across all Title III offerings may not exceed $100,000 in a 12-month period. Other investors can invest the greater of $2,000 and 5% of the lesser of annual income or net worth;

- Crowdfunding issuers are subject to disclosure requirements at the time of the offering (on Form C), during the offering’s progress and on completion of the offering (on Form C-U) and annually in the form of annual reporting requirements (on Form C-AR).

- Issuers in larger offerings face additional financial statement requirements – in offerings of over $100,000 in a 12-month period, financial statements must be reviewed by an independent accountant, and in offerings of over $500,000 in a 12-month period (except the issuer’s first offering), financial statements must be audited.

- Crowdfunding securities must be offered through a registered broker-dealer or a registered funding portal, a new intermediary type established by the 2015 rules. These intermediaries are mandated to take measures to reduce the risk of fraud, make required disclosures about issuers available to the public, provide communication channels to permit discussion of offerings on the platform, disclose the compensation received by an intermediary, provide educational materials to investors, and comply with additional requirements related to investor commitments, notices to investors, and maintenance and transmission of funds. Registered funding portals that participate in crowdfunding offerings may engage in a narrower set of activities than broker-dealers.

According to the SEC, As of December 31, 2016, 13 funding portals have facilitated equity crowdfunding offerings. FINRA has approved an additional 8 portals and many more will arrive in 2017. The five largest portals based on the number of offerings accounted for 71% of initiated offerings. Hence, the majority of offering activity is limited to only a quarter of the active intermediaries in the crowdfunding market. The results are more skewed towards the five largest intermediaries when considering only completed offerings; they accounted for more than 90% of market share.

The future of equity crowdfunding is bright but could be even brighter. Some Congressional fixes could make it explode. In the next post, I will discuss how Congress could help even more entrepreneurs and small businesses with some fixes.

By Jossey PLLC